6 Net 60 Vendors to Develop Your Business

Author: Dylan Buckley

January 23, 2026

9 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Net 60 vendors offer desirable payment terms that give your business additional time to pay invoices. But more than that, they help you develop your business and your business credit.

We’ve compiled a list of the top six net 60 vendors to help you connect with the right vendors without the guesswork.

The Best Net 60 Vendors

- Faire

- Amazon Net 55

- American Express Plum Card

- Lowe’s Commercial Account Card

- Home Depot Commercial Account

1. Faire

Whereas Mirta is focused solely on artisanal fashion, Faire is a comprehensive wholesaling platform with products that will appeal to nearly any business.

Some of the categories of products it sells include home decor, men’s and women’s apparel, beauty products, and more.

Faire’s net 60 terms come with no fees or penalties for using the full limit. This gives businesses a buffer period to sell their items without having to pay upfront.

Better yet, the average retail value of inventory tends to be higher than the net terms used.

Faire estimates that 10,000 of their approved retailers used $1,063 on average. In comparison, the estimated retail value of that inventory is $2,238.

Whereas other companies require you to undergo an application and approval process, Faire doesn’t.

All brick-and-mortar businesses that sign up with Faire automatically receive net 60 terms.

If you’re looking for a net 60 account to help you grow your business, Faire is an excellent option. However, like Mirta, Faire does not report payments to the business credit bureaus.

2. Amazon Net 55

Amazon Net 55 is a business line of credit that gives you, as the name suggests, a minimum of 55 days to pay back invoices.

Amazon is a massive supplier for businesses, making the Amazon Net 55 card an excellent choice for those who use Amazon regularly.

This card boasts no annual fee and no interest. It allows for multiple buyers, making it easy for several people in your business to purchase the goods your business needs.

Each month, they provide you with an itemized statement so you can easily keep track of your finances.

What’s worth noting is that some previous cardholders have said that the application and verification process can be tedious. If you are planning on applying for Amazon Net 55, keep this in mind.

Also note that at the time of this writing, they paused accepting new applications. That could change at any time.

3. American Express Plum Card

The Plum Card from American Express is not a traditional net 60 account.

However, it is a business credit card that offers a 60-day grace period when you want extra time to pay your bills.

This comes with the added benefit of zero interest and fees, so long as you make the payment by your agreed-upon payment due date.

The Plum Card is a business credit card that is unique in more ways than one.

Unlike other business credit cards, The Plum Card has no set spending limit. Rather, your credit limit is flexible and adjusts based on a wide range of factors, such as spending and payment history. This is a major benefit when you’re looking for business financing.

The only downside to the American Express Plum Card is that you can only tap into the cash-back benefits when you pay your bills early.

If you plan on using the 60-day grace period frequently in your small business, the 1.5% cash back on eligible offers won’t be accessible to you.

4. Lowe’s Commercial Account Card

The Lowe’s Commercial Account Card is perfect for the construction or home improvement company looking for net 60 payment terms within a card.

The Lowe’s Commercial Account card offers extended terms for new purchases, covering two billing cycles.

Beyond the extended credit terms, the Lowe’s Commercial Account card offers a wide range of benefits, such as:

- 5% discount on eligible in-store and online purchases from Lowe’s

- Itemized transactions, SKU-level details, and more in-depth order information

- Billing upon delivery

- Additional opportunities to earn through MVPs Pro Wallet

It’s a solid card that gives you net 60 payment terms plus a wealth of benefits that accompany card ownership.

5. Home Depot Commercial Account

If you’re considering the Lowe’s Commercial Account card, you should consider the Home Depot Commercial Account as well.

The Home Depot Commercial Account offers net 60 payment terms that allow you to purchase all of your tools and equipment while enjoying extended payments.

The Home Depot Commercial Account is a relatively straightforward credit card. You get buyer cards for your small business, set spending limits, and receive all of your transaction information.

Once it comes time to make payments on your purchases, you can pay by invoice.

As with other cards, the downside to net 60 payment terms here is that you can only unlock rewards by paying early.

The Home Depot Commercial Account offers a 2% early pay discount for those who pay within 20 days.

Alternatives to Net 60 Vendors

Net 60 vendors are one valuable resource to help you build your business and establish business credit.

However, they’re not your only option, especially when it comes to tier 1 business credit vendors.

Some viable alternatives to net 60 vendors that can help you tap into trade credit include:

- Net 30 Vendors: Net 30 vendors give you 30 days to pay back purchases (net 30 terms), interest-free. A few examples of net 30 accounts you should consider looking into include Grainger, Office Garner, and Quill. Consider taking a look at our Wise Business Plans net 30 review as well!

- Business Credit Cards: Business credit cards help you build your business credit score using more traditional banking means. You have the option between secured and unsecured business credit cards, with the former being more accessible. Examples of these include the Valley Visa Secured Business Credit Card and the FNBO Business Edition Secured Mastercard.

- Charge Cards: Corporate charge cards are similar to credit cards. However, their payment terms require balances to be paid in full when the repayment period rolls around. Popular corporate charge cards include the Ramp Corporate Card and the BILL Spend & Expense Card.

How to Build Your Business Credit with Net 60 Vendors

Net 60 vendors can help you achieve two goals: tapping into extended payment terms that may be more desirable for your business and helping you build business credit.

But when it comes to the latter, it’s important to be strategic.

Here are a few helpful tips on how to build your business credit with net 60 vendors:

- Always research each vendor to make sure they report to the main business credit bureaus. These include Dun & Bradstreet, Experian Business, and Equifax. If they don’t, your payments won’t count toward building your business credit.

- Stay on top of all of your vendor credit accounts. It’s easy to sign up for too many vendors and end up with far too many invoices to properly manage, affecting cash flow and business credit. This is especially true for newer business owners looking for net terms that work for them.

- Be punctual about your payments. Late payments will hurt your credit and be subject to each vendor’s specific interest and late fees that they have in place.

- Stay on top of your credit reports to address any inconsistencies regarding reported payments. You want to make sure that each payment being reported by net 60 vendors is accurate.

- Pay early if you are incentivized to. Early payments can bolster your business credit and help you tap into the cash-back offers and discounts mentioned above.

How FairFigure Can Help You Build Business Credit

Building business credit doesn’t have to be a complicated process.

It also doesn’t have to be one marred by a host of hidden fees or undesirable payment terms that leave you wanting more. You can access higher business credit tiers that offer more for your business.

Here’s where we come in!

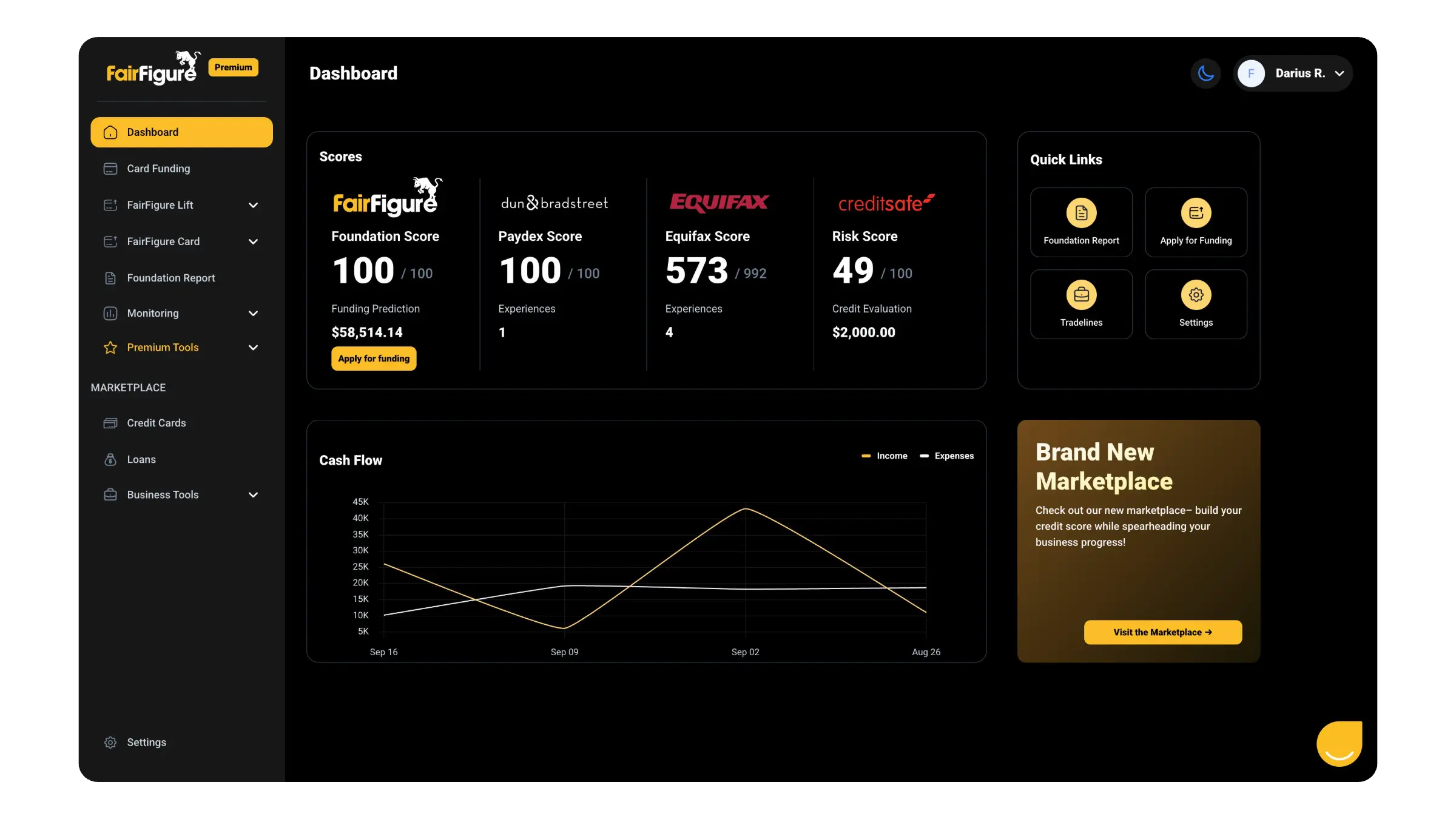

FairFigure offers two ways to help you build business credit: our FairFigure Card and our comprehensive business monitoring solutions.

Our FairFigure Card is not a charge card or a credit card like other cards on this list. Instead, we provide you with funding based on your monthly recurring revenue. This is all without a required deposit, personal guarantee, or a personal credit check.

Better yet, you decide your own payment terms, gaining access to a four or eight-week payback plan.

To build your credit even faster, you can sign up for our business credit monitoring services.

For just $30 a month, we help you stay on top of your business credit health and report your payment as a tradeline to help you establish credit history.

We report payments to Equifax Business, Creditsafe, and the Small Business Financial Exchange (for which the SBFE reports to D&B, Equifax, and Experian). We report to our own Foundation Report as well.

Create an account with us today to get started!

More articles

Read More >

February 12, 2026

1 min read

February 12, 2026

1 min read

February 12, 2026

1 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure