8 No PG Business Credit Cards

Author: Dylan Buckley

January 23, 2026

12 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Traditional business credit cards always require a personal guarantee when you don’t have stellar business credit and sizable, consistent revenue.

Some resources will tell you that Chase, BofA, Amex, and other name-brand cards can be acquired without a PG. However, this is far from true.

But that doesn’t mean you’re out of options if you want to avoid a personal guarantee.

We’ve reviewed and compiled the best no PG business cards below for you to review. Discover how FairFigure can help you build credit and access funding with no PG, no personal credit, and no paperwork.

The 8 Best No PG Business Credit Cards

- The FairFigure Capital Card

- Shell Small Business Card

- Chevron/Texaco Business Card

- Phillips 66 Commercial Credit Card

- BILL Spend and Expense Card

- Ramp Corporate Card

- Brex Corporate Card

- Emburse Corporate Card

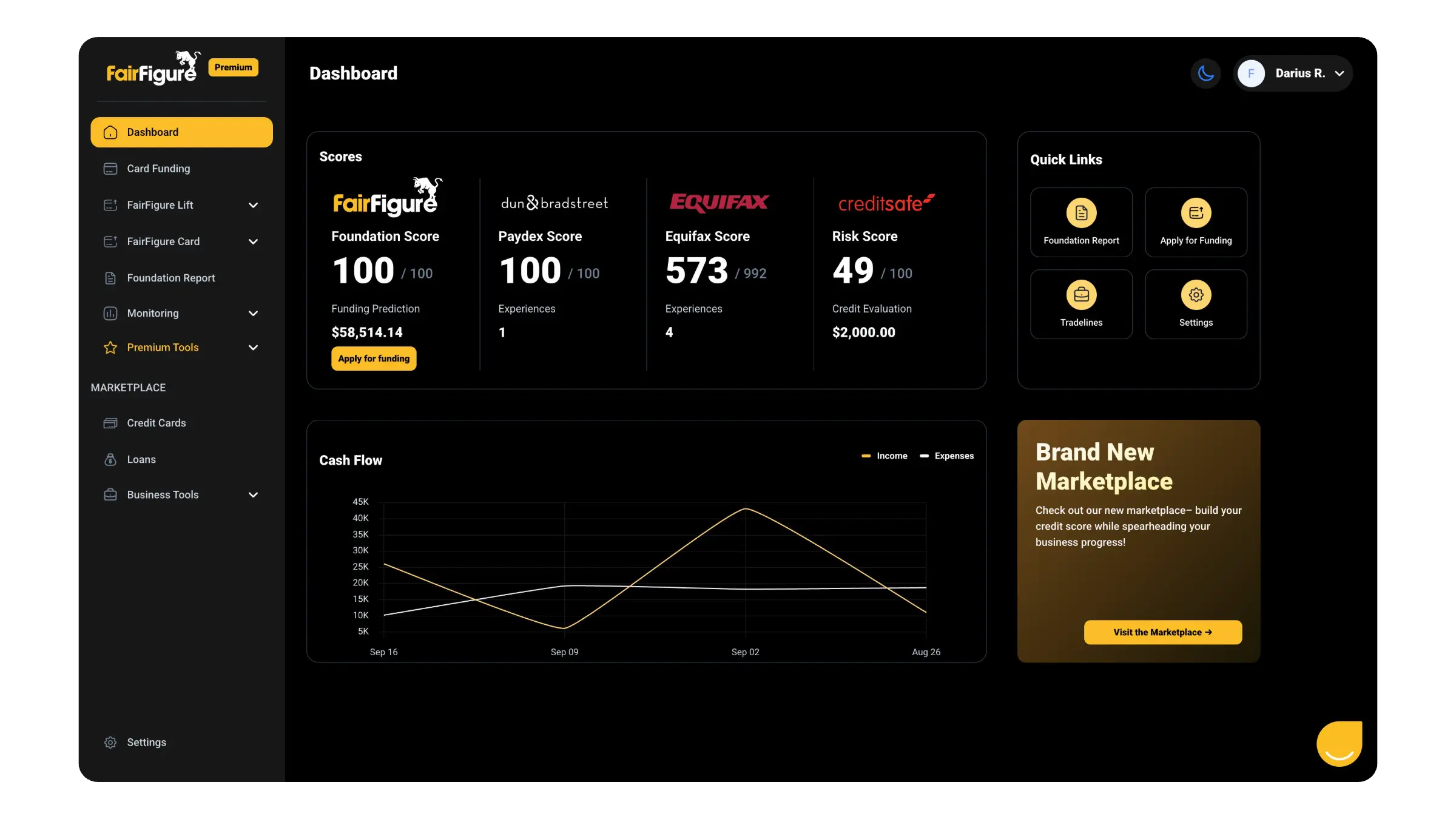

1. The FairFigure Capital Card

The FairFigure Capital Card helps you build credit with fewer restrictions. This business credit builder card is a true EIN only business credit card. It requires no personal guarantee, credit, or lengthy applications to get started.

The FairFigure Capital Card extends funding based on your recurring monthly revenue. So long as you make at least $2,500 in monthly revenue and have been in business for at least three months, you can qualify.

Once in, you are able to select your own payback terms. The FairFigure Capital Card offers four-week and eight-week payback terms.

You don’t need to put down a deposit to get a card. But much like with the other business cards on this list, you do get perks.

These include cash back on eligible purchases and increased funding with each on-time payment as you scale your business.

As you use your card, you will build business credit effectively. FairFigure reports to Dun & Bradstreet, Equifax Business, CreditSafe, the Small Business Financial Exchange, and their own foundation report.

(This goes the same for trade credit reported with our credit monitoring service. Need something that acts like a vendor account or vendor credit alongside funding? Consider FairFigure!)

The FairFigure Capital Card is one with fewer barriers to entry, ample perks, and flexible funding that any small business owner will appreciate.

2. Shell Small Business Card

Whether you operate a small fleet or you need a business credit card with no PG that will benefit your business regardless, the Shell Small Business Card is one to consider.

Shell Fleet Cards offer numerous benefits for growing businesses. The most notable are the security and control features.

With your Shell Small Business Card, you can monitor spending and set limits with ease. You get detailed spending reports and can suspend or terminate cards on the go.

Shell offers 24/7 customer service to support you when you need it. They also offer seamless account management through the WEX Fleet SmartHub.

That being said, the savings benefits are likely the most exciting to businesses. With the Shell Small Business Card, you will:

- Be able to use your card and fill up at 13,000 Shell stations and participating Jiffy Lube locations throughout the country

- Receive rebates of up to 6¢ per gallon

- Save less at participating Jiffy Lube locations

- Benefit from no card fees (these include setup fees, monthly fees, and annual fees)

You’ll find that the Shell Small Business Card is quite beneficial for building strong credit. The Shell Small Business Card reports to three major business credit bureaus: D&B, Experian, and Equifax.

3. Chevron/Texaco Business Card

Do you prefer to spend money at Chevron and Texaco instead? Don’t worry. There’s a fleet card for any small business out there. Another option besides Shell is the Chevron/Texaco Business Card.

The Chevron/Texaco Business Card is another supportive fleet card for business owners. As with our previous card, they have comprehensive spending controls and monitoring, no setup or annual card fees, and are accepted at more than 8,000 Chevron and Texaco stations in the U.S.

However, there are a few notable features that make it stand out from similar fleet card options.

The Chevron/Texaco Business Card comes with a host of financial benefits. One such example is the advanced data capture and reporting. This can help you identify areas where you can save to reduce spend throughout the year.

Are you a small business looking to streamline your accounting approach? The Chevron/Texaco Business Card offers automatic accounting so you can spend less time on paperwork.

The savings offered by this card are great as well and extend beyond Chevron/Texaco stations. You can save money on things like auto parts, tires, hotels, and beyond when you use your Chevron/Texaco Business Card.

The fleet card you select will ultimately boil down to where you load up most. But if you’re not picky, the Chevron/Texaco Business Card is an exceptional no PG business credit card.

4. Phillips 66 Commercial Credit Card

The Phillips 66 Commercial Credit Card is our final no PG fleet card option.

The Phillips 66 Commercial Credit Card is accepted at Phillips 66, Conoco, and 76 locations nationwide.

The benefits are a bit more lackluster in comparison to other fleet cards. However, they do exist. Some of the advantages of the Phillips 66 Commercial Credit Card include:

- No annual fee or fee for requesting more cards (there’s only a $1.99 fee if you have a balance of at least $2.50 and get paper statements)

- The ability to refuel without needing a physical card

- $0 fraud liability

- Seamless online account management

- Account alerts and notifications to stay on top of your spending activity

They have a 23% APR, $2.99 minimum finance charge, and late fees of $20.00 or 2.50% (whichever is greater). If you trigger the default APR, you could see rates of 29.99%. This could happen if you go past max credit utilization or pay your business line off late.

Take care to review this card thoroughly before you apply for it.

5. BILL Spend and Expense Card

The BILL Spend and Expense Card (formerly Divvy) is a strong choice for businesses that want to simultaneously fund their growing business as well as change and refine their accounting approach.

The BILL Divvy Card and BILL Divvy Reserve Card offer three key advantages: advanced accounting support, improved transparency and management, and better perks than traditional business credit cards.

BILL Divvy cards are funding opportunities that are baked into BILL’s accounting solutions. Your new credit card comes with integrations with QuickBooks and NetSuite, automatic expense management with BILL Spend & Expense software, and so much more.

They make it easy to control spend and issue cards to every member of your team. It comes with a mobile app so that you can see spend or approve transactions on the go. You also have fraud protection in the event that someone outside of your business uses your card.

Speaking to the card’s benefits, the BILL Spend and Expense Card comes with:

- A rapid application process and flexible underwriting to provide you with a card that best suits your business

- Equally flexible rewards that will help you earn cash back with every transaction

- No annual fees

- Virtual and physical versions of the card so you can start using your credit line right away

BILL doesn’t offer clear qualification terms for small businesses. However, you can apply online quite easily without impacting your credit.

BILL reports all transactions to one business credit reporting agency: the Small Business Financial Exchange.

6. Ramp Corporate Card

The Ramp Corporate Card is a corporate credit card solution that has managed to generate some major buzz.

Ramp, like BILL, offers accounting for businesses first and foremost. Also like BILL, the Ramp Corporate Card is an additional offering that comes with all of Ramp’s other financial products.

The Ramp corporate card helps you track spend on one intuitive platform. You can easily set limits and auto-rejections on certain categories for each of your employees, upload receipts on the go (text and other methods), and unlock savings insights in real-time.

You get rewards like 5% savings. You also don’t have to deal with a personal credit score check, and funding is determined by revenue or dollars raised.

That being said, the one major issue with the Ramp Corporate Card is that some small businesses just starting out may not qualify for this card.

Most of the eligibility requirements are standard, such as needing to have a corporation (or LLC or LP) registered in the United States, a physical address, and most of your transactions occurring in the U.S.

However, you must also have $25,000 in cash in any U.S. business bank account linked to your application. If you don’t have this amount on your person as of now, you won’t be able to get a Ramp Corporate Card.

Income and investing requirements can be rather stringent for corporate cards like Ramp’s. Make sure you meet these requirements before you spend any time filling out these applications.

7. Brex Corporate Card

Brex Corporate Card is another popular option for businesses wanting a no PG credit card.

The Brex Corporate Card is a part of Brex’s broader expense management solutions. As with our previous cards, this means that it’s much easier to set spend control for employees, track activity, and simplify your financial activity.

The Brex Corporate Card comes with a host of benefits for cardholders. These include:

- Higher credit limit than the average corporate card. Limits may be 10 to 20 times higher in comparison.

- Exclusive sign-up offers for businesses you may need a product or service from. These include AWS, Salesforce, and Google Ads.

- Strong rewards for a host of spending categories. You get a lot in the way of perks. The Brex Corporate Card offers 7x cash back on rideshare, 4x cash back on Brex Travel, 3x cash back on restaurants, 2x cash back on software subscriptions, and 1x cash back on all other transactions.

- A miles transfer program so that you can use your Brex card to get free travel. Eligible airlines include Singapore Airlines, Qantas, and Air France, just to name a few.

- You can build your business credit score and credit history with the Brex Corporate Card. They report to the three main business credit bureaus: Equifax, Experian, and D&B. This will help you improve your credit report so you can tap into more funding.

All of the perks above can make the Brex Corporate Card a standout choice. But there’s a caveat.

You need to make a substantial amount of money in order to qualify for this card.

Brex primarily services high-growth businesses and mid-market businesses. As such, you’ll need to have at least $50,000 in your bank account to be considered. Many businesses using the Brex Corporate card make mid-six-figures annually.

Brex gets to the point when talking about who they’re most likely to approve. Other considerations when approving business include:

- Seeing whether they’ve received equity investments or are actively seeking them out

- Make more than $1 million a year in revenue

- Have more than 50 employees

- Referred tech startups who meet the above or who will likely meet the above

Put simply, those who meet the qualifications are most likely to be approved, although you don’t have to be a perfect fit. Still, the high income requirements can be restrictive.

Brex might not be for all small business owners. But if you do qualify, definitely consider it.

8. Emburse Corporate Card

The Emburse Corporate Card is our final corporate card that also features expense management services.

Emburse is celebrated for its smart approval features that can help you manage employee spend with ease, real-time insights and reports, and mobile receipt capture for easier financial tracking.

They offer a reported 1% cash back on all transactions. They also offer physical and virtual cards for organizations that prefer either/or (or need access to both when they first get approved).

The granular spending rules and the seamless account management are what stand out most with the Emburse Corporate Card. There aren’t many other perks or clear eligibility guidelines.

However, the latter may be a positive if your business is struggling to secure other corporate cards. Looking further into the available information on their website regarding benefits for users, features, and beyond will be crucial in making your final decision.

No PG business credit cards help you access funding and build credit without putting your assets at risk. If you want a no PG credit card that supports your business, consider FairFigure.

Apply for your FairFigure Card now, and take advantage of our multi-bureau business credit monitoring services for further support building credit.

Looking for More Guidance? Read These!

More articles

Read More >

January 23, 2026

5 min read

January 23, 2026

5 min read

January 23, 2026

3 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure