Startup Business Credit Cards With No Credit/EIN Only

Author: Nick Alex Gallo

January 22, 2026

12 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Business credit cards can be excellent tools for facilitating day-to-day purchases, earning cash back rewards, and building business credit. However, they often require you to provide your Social Security Number and sign a personal guarantee.

Let’s review some of the best startup business credit cards you may be able to qualify for with just your Employer Identification Number (EIN) and no hard credit check on your personal credit score.

Best Startup Business Credit Cards With No Credit/EIN Only

- FairFigure Capital Card

- BILL Divvy Corporate Card

- Stripe Corporate Card

- Shell Small Business Card

- ExxonMobil BusinessPro Card

- Phillips 66 Business Card

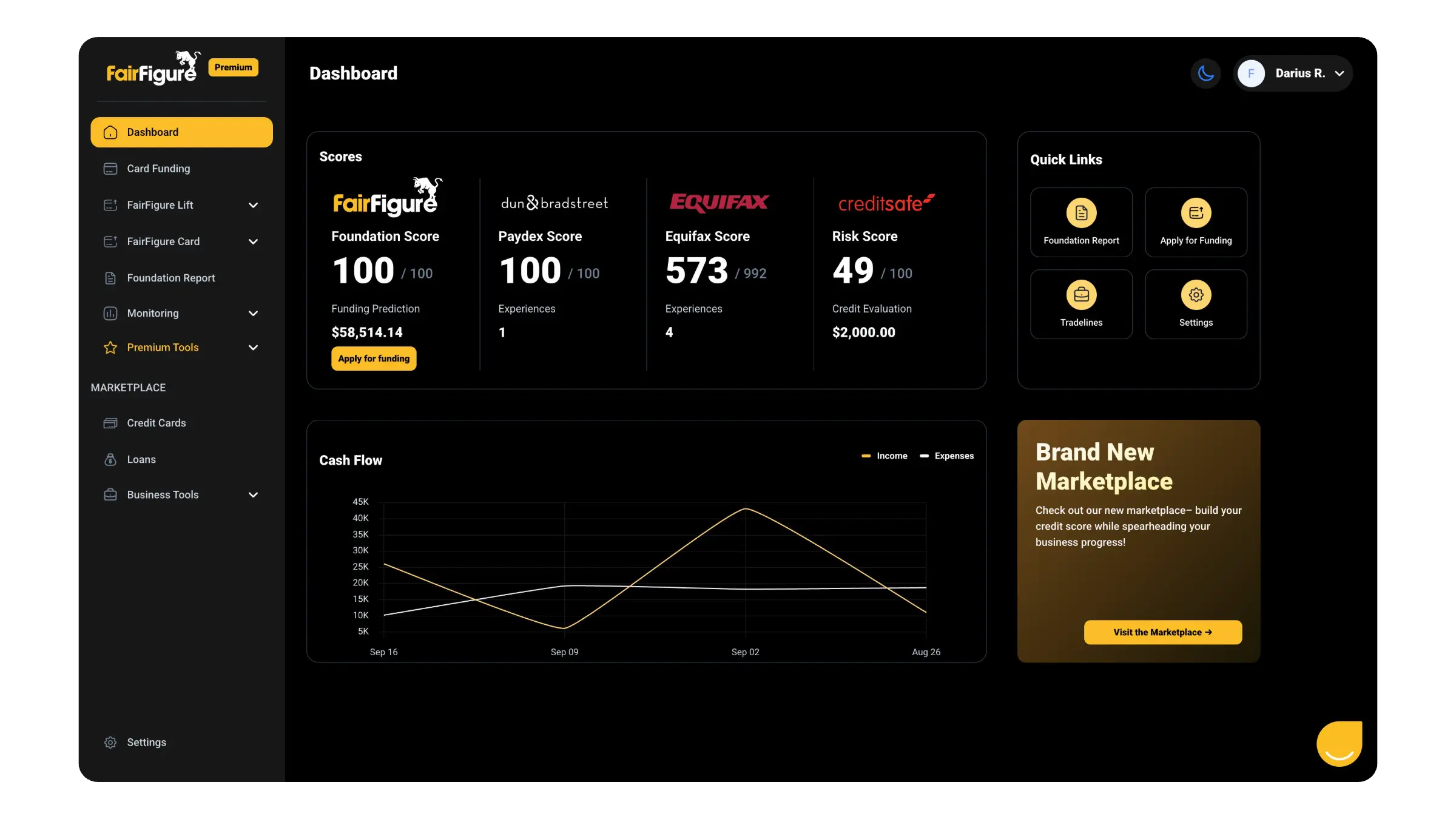

1. FairFigure Capital Card

The FairFigure Capital Card is an excellent business credit builder card for new business owners. It's a true EIN-only charge card you can qualify for without a credit check or personal guarantee.

Instead of your credit history, FairFigure determines your eligibility primarily based on your finances. To qualify, your company only needs to have three months of business history and at least $2,500 in monthly recurring revenue.

Assuming you meet these requirements, you can open an account for just $30 per month. In addition to the capital card with a credit limit of at least $1,000 and a repayment term of up to eight weeks, the subscription also includes:

- Business credit monitoring: Get access to your Dun & Bradstreet, Equifax, and Creditsafe business credit scores and credit reports, plus our proprietary Fundex Score and Foundation Report, which provide insight into both your credit and finances.

- Personal credit monitoring: Unlock all three major personal credit reports, including those from Equifax, Experian, and TransUnion. You can also view your VantageScore 3.0 rating based on the data compiled by each credit bureau.

- Credit report corrector tool: FairFigure’s Business Credit Corrector streamlines the process of disputing errors in each business credit bureau's report, which is otherwise harder than it is for consumers and personal credit reports.

- Additional vendor tradeline: We’ll report your $30 monthly payment to three business credit bureaus, including Equifax Business, Experian Business, CreditSafe, and the Small Business Financial Exchange (SBFE) as a vendor tradeline.

Like your monthly subscription, we report the FairFigure Capital Card itself to Equifax Business, Experian Business, CreditSafe, and the SBFE. It shows as a financial tradeline, which makes it even more impactful to each business credit score.

However, we don’t report either tradeline to the personal credit bureaus, which helps protect your score. You can learn more about other cards like this in our related article, Which Business Credit Cards Do Not Report Personal Credit?

2. BILL Divvy Corporate Card

Bill.com offers two separate corporate charge cards: the original BILL Divvy Card and the more recently developed BILL Divvy Reserve. You can apply for both without affecting your credit, as they only require soft personal and business credit checks.

Its other qualification requirements include:

- Be in the U.S.

- Have good to very good credit

- Keep at least $20,000 in cash reserves

BILL also considers your annual revenue and the length of your business history, but its expectations are more flexible and can vary depending on the circumstances.

If you’re approved for a credit line with either card, which can be as much as $5M, the primary benefit is the connection to Bill.com’s powerful expense management software. Among other things, it allows you to:

- Create virtual cards for each member of your team

- Set individual budgets to control company spend

- Automatically track, categorize, and analyze expenses

Of course, there are also some significant differences between the two corporate cards. Arguably the most notable is that the original BILL Divvy card requires no deposit, but the Reserve is a secured credit card.

In addition, they have very different rewards structures. The original card earns at variable rates depending on both the category and your repayment term, which can be weekly, bi-weekly, or monthly.

Here’s how it works for the first $5,000 in spend per month:

BILL Divvy Card Rewards

| Spending Category | Weekly | Semi-Monthly | Monthly |

|---|---|---|---|

| Restaurants | 7x | 4x | 2x |

| Hotels | 5x | 3x | 2x |

| Software Subscriptions | 2x | 1.75x | 1.5x |

| Everything Else | 1.5x | 1x | 1x |

After the first $5,000, all expenses earn 1.5x points. Meanwhile, the Reserve Card offers cash back that starts at 1.5% of eligible purchases and increases with higher spending, though by an unspecified amount.

In addition, BILL reports both of its corporate cards to the SBFE, which may help you build business credit.

3. Stripe Corporate Card

You’re probably already familiar with Stripe as one of the world’s largest payment platforms. In 2024, businesses processed more than $31 billion through the site from Black Friday to Cyber Monday alone.

If you’re one of the many business owners who already use Stripe’s systems to collect payments from your clients or customers, you may be a good candidate for its corporate charge card.

There’s typically no hard credit check required for the account, but you must receive an invite from the platform to apply. Your eligibility is primarily based on your banking history and revenue collection activities on the Stripe platform.

Like other corporate cards, Stripe’s integrates seamlessly with the issuing platform’s expense management software. As usual, it allows you to issue additional employee cards, as well as track and control company spending.

You can also earn cash back rewards on your purchases at a rate of 2% for your top two spending categories each month and 1% for all other spending. Occasionally, Stripe may offer bonuses in specific categories.

In addition, the Stripe card provides extensive partner-based discounts and benefits. For example, that includes:

- Airtable: $2,000 in credit for up to 5 users for 20 months

- AWS: $5,000 in credits

- Carta: Access to Launch, and 20% off waived implementation fees

- Expensify: 50% off for 6 months

- Gem: Two years free for teams of less than 15

- Google Ads: $500 in credit after your first $500 in spend

Stripe currently reports your card activities to the SBFE, which can help you establish your business credit score.

4. Shell Small Business Card

If your business model involves a significant amount of driving for you or your employees, gas or fleet credit cards can be an excellent financing option. The Shell Small Business Card is one of the most attractive ones to consider.

Shell has several different fleet cards, all of which are accepted at nearly 13,000 Shell stations across the U.S., the largest retail fueling network in the country. They’re also usable at participating Jiffy Lube locations.

However, the Shell Small Business Card is the only one of Shell’s accounts that lets you carry a balance over from one month to another. Like the corporate cards discussed previously, all the others are charge cards.

Also like corporate cards, Shell’s fleet cards include powerful software that can help you control company spending.

Its fleet management solution can help you streamline accounting processes and limit spending by product, timing, or location—down to individual fuel stations.

In addition, you can get significant rewards and discounts on your spending. Here’s how it works:

- Promotional offer: For the first six months (180 days), you can earn rebates of 25 cents per gallon on the first 6,000 gallons at Shell stations each month.

- Standard rebates: After the promotional period, the Shell Small Business Card earns tiered rebates on up to 20,000 gallons per billing cycle, topping out at 6 cents back.

- Jiffy Lube partnership: The card automatically nets you a 15% discount on oil changes and preventative services at more than 2,000 participating Jiffy Lubes.

You can qualify for the card with your EIN only if your business is at least one year old and earns $1 million or more in annual revenue. However, if you fall short of that, you must provide a personal guarantee and undergo a personal credit check upon applying.

Fortunately, Shell reports your activities to all three major business credit bureaus, including Dun & Bradstreet (D&B), Experian Business, and Equifax Business.

5. ExxonMobil BusinessPro Card

ExxonMobil’s BusinessPro Card is another good option to consider if you expect to purchase significant amounts of fuel as part of your business. It’s a true revolving credit card that allows you to carry a balance from one period to the next.

Its fleet management software has similar capabilities to Shell’s, including the ability to control spending at the card, product, or location levels, plus features that automatically streamline fuel accounting processes.

The reward structure is also similar, with rebates of up to 6 cents per gallon at Exxon and Mobil gas stations. However, there is no upper limit, with all purchases above 10,000 gallons qualifying for the maximum rebate.

If your spending is high enough, that can help make up for the lack of a promotional offer.

Unlike the Shell card, ExxonMobil’s card is accepted at roughly 95% of all gas stations in the U.S. However, there is a one-time setup fee of $40 and a $2 monthly fee to retain access to that benefit.

You can apply for the ExxonMobil BusinessPro Card with just your EIN if you meet certain requirements. In this case, you must be a corporation with more than $1 million in annual sales and three years of business history.

Otherwise, once again, you must sign a personal guarantee and undergo a personal credit check to apply. Either way, your ExxonMobil card activities should be reported to D&B and Experian Business.

6. Phillips 66 Business Card

Phillips 66 offers two viable fuel cards for those who have significant gas expenses: the Business Fleet Card and the Business Universal Card, each with its own pros and cons.

The Business Fleet Card is aimed at those who want maximum savings, with no annual or other card fees. Meanwhile, the Universal Card prioritizes flexibility. You’ll have to pay some recurring fees, but it’s accepted at 95% of all U.S. gas stations.

Flexibility may be a more important consideration here than with other fuel cards, as there are only 7,500 gas stations in network across the country for the Business Fleet Card. That’s roughly half the size of the Shell and ExxonMobil networks.

Otherwise, the cards offer similar benefits, including rebates of up to 7 cents per gallon on purchases at Phillips 66, Conoco, and 76 gas stations. As of the time of writing, there’s also a promotional rate of 10 cents per gallon for your first six months.

Both cards also include access to Phillips 66 fleet management software, with tools to monitor and control employee spending as well as automate fuel accounting processes.

In addition, Phillips 66 cards may be more accessible with your EIN only than other fuel cards. You might avoid signing a personal guarantee if your company has been in business for more than three years and has an established business credit history.

FAQs

Can You Get a Business Credit Card With Just an EIN Number?

You may be able to get a small business credit card with just an EIN from a credit card issuer like FairFigure or Shell. That allows you to protect your personal credit score and avoid taking on personal liability for your business’s debt.

However, qualifying for a business card with your EIN only can be challenging, depending on the provider. You often must be able to demonstrate that your company is well-established with high revenues, years of operational history, and good credit.

What is the Easiest Business Card to Get Approved For?

The easiest business card to get approved for depends on your unique strengths. For example, some issuers favor borrowers who have good personal credit, while others don’t require a personal guarantee and prioritize healthy annual revenues.

That said, one of the easiest business cards to get approved for is the FairFigure Capital Card, which only requires that you have three months of business history and $2,500 in monthly recurring revenue, which is just $30K per year.

Can a New LLC Get a Credit Card?

A new LLC can get a credit card, but the small business owner will typically have to sign a personal guarantee in order to qualify. Many card issuers require this to reduce their risk, especially for your first couple of years in business.

However, a new LLC may be able to get a business credit card with EIN only from certain providers if it meets their financial requirements, such as with the FairFigure Capital Card.

Can I Get a Business Credit Card With a 500 Credit Score? You may be able to get a startup business credit card with a 500 credit score, as every lender has unique qualification requirements. For example, the FairFigure Card doesn’t factor in your personal credit history.

However, credit card issuers generally consider 500 a bad credit score, and it can significantly limit your financing options. You may have to settle for a somewhat less advantageous account, such as a secured business credit card.

If you’re in this situation, consider the card options in our article, Secured Business Credit Cards That Report to D&B.

More articles

Read More >

January 22, 2026

13 min read

January 22, 2026

7 min read

January 22, 2026

12 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure