Uline Net 30 Review (Great for Business Credit)

Author: Nick Alex Gallo

January 23, 2026

6 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Opening net 30 accounts is one of the best ways to build business credit from scratch. They’re often available to new business owners who might not be established enough to qualify for higher-tier tradelines, like loans or credit cards. Our Uline net 30 review will help you determine whether the account is worth applying for or if you should focus on other trade credit accounts.

Our Verdict on Uline’s Net 30 Account

If you’re a new small business owner just getting started with business credit, it’s well worth submitting an application for Uline’s net 30 account. Uline reports to two of the major business credit bureaus, D&B and Experian Business.

In addition, there are virtually no downsides. Uline’s application process is quick and easy, with no application fee. There’s also no recurring fee to maintain access to your credit line, so the account is essentially free.

Uline also offers an extensive product suite, with something for every business model from office-based organizations to manufacturing companies.

If Uline’s net 30 account sounds like it might suit you, read on to learn more about the tradeline’s pros and cons:

- D&B and Experian Reporting

- No Application or Recurring Fees

- Practical Business Products

- Potential Reporting Policies

Uline Net 30 Account Pros

D&B and Experian Reporting

Building business credit primarily involves establishing a positive credit history with various business credit bureaus. Like on the consumer side, lenders tend to pull credit reports from three main bureaus: Dun & Bradstreet (D&B), Experian Business, and Equifax Business.

Uline reports to both D&B and Experian Business. That may be one short of perfect, but unlike consumer credit accounts, business tradelines rarely report to every major credit reporting agency. On the business side, reporting to two out of three is competitive.

That’s especially true in this case since D&B is also arguably the most popular business credit bureau of the three. Not only is it the oldest, but it’s also well-known for establishing the widely used DUNS number system.

No Application or Recurring Fees

Many tier 1 business credit vendors charge a fee for the right to access their net 30 payment terms. If you’re lucky, it might be a one-time application fee, but it can also be a monthly or annual subscription.

For example, there’s a $99 annual recurring fee for the Wise Business Plans net 30 account. That might not be too expensive on its own, but it can become financially burdensome by the time you have enough tradelines to flesh out each credit report.

Fortunately, Uline doesn’t charge any one-time or recurring fees. Outside of the cost of your orders, it’s completely free to access.

Practical Business Products

Business owners often use net 30 terms as a means to an end. They’re one of the best ways to build business credit when you can’t get other tradelines, but the issuers may offer products or services that don’t align with the business’s needs.

Many net 30 vendors specialize in relatively niche offerings that may provide limited benefits to you in large quantities–like a business plan. As a result, your purchases can feel forced, made solely for the purpose of creating a payment history.

However, Uline offers an extensive list of practical business products, with more than 42,000 shipping, industrial, and packaging items. For example, that includes disinfectants, spray bottles, office chairs, folders, boxes, and more.

Uline Net 30 Account Cons

Potential Reporting Policies

Uline doesn’t publicly disclose much about the details of its reporting policies, but reports from previous users indicate they may include some limitations you should understand before opening a Uline net 30 account.

Some claim that you have to make up to five purchases before Uline starts reporting your activities to the business credit bureaus. Others claim Uline only reports your purchases quarterly rather than monthly.

Either way, you may experience delays in seeing your Uline activities show up in your business credit reports, which is less than ideal.

Another potential issue is that some users claim Uline might not report your payments unless you meet a minimum order threshold. And unfortunately, Uline doesn’t confirm this policy or the amount on its website.

Some users say you need to purchase at least $50 per order, which is a common rule of thumb for net 30 accounts. Others suggest you actually need to spend at least $100, and that ambiguity could end up costing you if you spend too much or too little.

Uline Net 30 Approval Requirements

One of the fundamental advantages of tier 1 tradelines is that they’re easy to qualify for, and Uline’s net 30 vendor account falls squarely into that category. Securing approval for the credit line is typically possible for both new and established businesses.

If you’ve never used Uline before, register for an account to get started. You’ll only need to provide the most basic information about your business, like your company name, number of employees, and billing address, then complete a two-step verification.

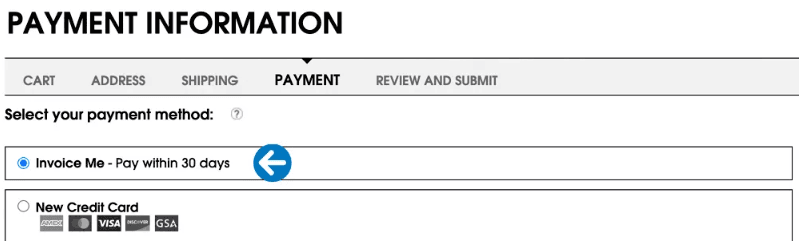

Once you finish the registration process, search the Uline catalog for $50 to $100 worth of products (before taxes and shipping) and go to check out. When you reach the payment page, select “Invoice Me - Pay within 30 days.”

Typically, you should qualify to use the net 30 payment term as long as you don’t already have any negative items in your business credit history, such as a late payment.

Build Business Credit With FairFigure

Net 30 accounts are a time-tested way of establishing business credit, but they’re not right for everyone.

It can take a significant amount of time and capital to establish credit history with them, and they don’t impact your business credit score as much as accounts from the higher business credit tiers, like financial tradelines.

FairFigure is an alternative that offers many attractive benefits.

First, you get two tradelines for the price of one, and one of them is a financial tradeline. When you sign up for a subscription, you unlock the FairFigure Capital Card, which you can use to facilitate payments with any business, not just a single net 30 vendor.

We’ll report both your subscription and your card to the business credit bureaus, including Equifax Business, CreditSafe, and the Small Business Financial Exchange.

In addition, you unlock consumer and business credit monitoring, which includes access to all three major personal credit reports, two sets of major business credit reports and scores, and our Business Credit Corrector tool for disputing errors.

Like net 30 accounts, FairFigure is available to a wide range of businesses, as eligibility and your credit limit are based solely on revenue. You can qualify as long as you have at least $2,500 in monthly recurring revenue.

Join now with your Employee Identification Number (EIN) and no personal guarantee to start building good credit.

More articles

Read More >

January 23, 2026

5 min read

January 23, 2026

5 min read

January 23, 2026

3 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure