Wise Business Plans Net 30 Review

Author: Aaron V

January 23, 2026

6 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Unlocking Business Credit: A Review of Wise Business Plans’ Net 30 Account

You’ve just begun your business credit journey and you’ve come across Wise Business Plans NET 30 Account on a NET 30 Vendor List and you’re looking for a review before signing up right? Let’s walk through how it works and what our thoughts and opinions are.

This appears to be a logical product to purchase after you’ve formed your LLC. Once you have your papers in line, you can start formulating your business plan with them.

Understanding Net 30 with Wise Business Plans

Net 30 accounts are trade credit lines allowing businesses to buy now and pay later, typically within 30 days. This arrangement is particularly beneficial for small businesses or startups needing to manage cash flow while accessing necessary services or products. It's also a part of business credit building. A few net 30 accounts are a great foundation for building your scores.

We would classify Wise Business Plans with other tier 1 business credit vendors because they make qualifying for payment terms easy.

The Significance of a Business Plan

Net 30 accounts can be powerful credit-building tools and helpful financing arrangements, but they’re only worth opening with vendors who offer a product or service that benefits your business. It’s pretty inefficient to make consistent purchases just to build a payment history.

As you can probably guess, Wise Business Plans’ primarily offers business plan writing services. The vendor has a team of MBA plan writers who do market research and craft custom business plans for specific situations, often to satisfy various third parties.

For example, some types of business plan writer services you can request include:

- Bank business plans: Bank financing can be incredibly valuable to your small business, but it’s quite challenging to secure. Often, you’ll need to provide a detailed business plan as part of your application. Wise offers business plans designed to impress loan officers and help you qualify for the best bank funding.

- Investor business plans: If you’re more interested in equity financing than in taking on debt, you’ll need to convince investors that your business will provide a strong return on their investment. An investor business plan is designed to strengthen your pitch and help you sell shares of your company.

Of course, a strong business plan is the foundation of any successful venture. Even if you’re not planning to share it with anyone outside the company, it can be a helpful tool for outlining your goals, strategies, and financial projections.

Eligibility and Requirements

To qualify for a Wise Business Plans Net 30 account, businesses must meet specific criteria:

- US-Based Business: The service is exclusively for businesses operating in the United States.

- EIN Number: An Employer Identification Number is mandatory. Businesses without one can obtain it from the IRS.

- No Major Business Delinquencies: A clean business credit history is essential.

- Business Reporting: Accounts are reported to credit bureaus like Experian Business and Equifax Business, aiding in building a business credit profile. -*If you are unsure: You can always check your reports at no cost with FairFigure before applying.

Application Process

The application process is straightforward. The application can be completed online.

- Business Information: Enter your business name, industry, entity type (like LLC or Corporation), and EIN number. If applicable, include your DUNS number, obtained from the Dun & Bradstreet website.

- Business Start Date and Size: Provide details like the date of formation and the number of employees.

- Estimated Annual Income: Be realistic in your estimates; this affects your credit line.

- Business Address and Contact: Use a business or virtual address rather than a home address. Ensure you have a dedicated business phone number and email.

- Service Selection: Choose from services like business plan creation, business formations, and tax ID number assistance, based on your business needs.

Understanding Fees and Terms

A $99 annual fee is associated with the Net 30 account. This fee might be reported to credit bureaus, contributing to your business credit history. Post-application approval takes about 24 to 72 hours.

After Approval

Once approved, you can access various services on Net 30 terms. For specific services like business plan creation, Wise Business Plans may provide additional guidance or consultation.

The Importance of Documentation

Preparing essential documents beforehand, such as your EIN and DUNS numbers, streamlines the application process. Ensure all information is accurate and up-to-date to avoid delays.

Does Wise Business Plan Report?

To build business credit with a net 30 account, you need to open the tradeline with a vendor who reports to at least one business credit bureau. That way, your activities will show up in your credit reports and contribute to your business credit history.

Three of the primary business credit bureaus include Dun & Bradstreet (D&B), Experian Business, and Equifax Business. Most lenders pull your company’s credit history from one of these agencies, though there’s usually no way to know which in advance.

As a result, the ideal net 30 business account reports regularly to all three. Wise Business Plan reports its vendor tradeline to Equifax and Experian, but it doesn’t share its data with D&B. Instead, it reports to CreditSafe, a slightly less well-known credit reporting agency.

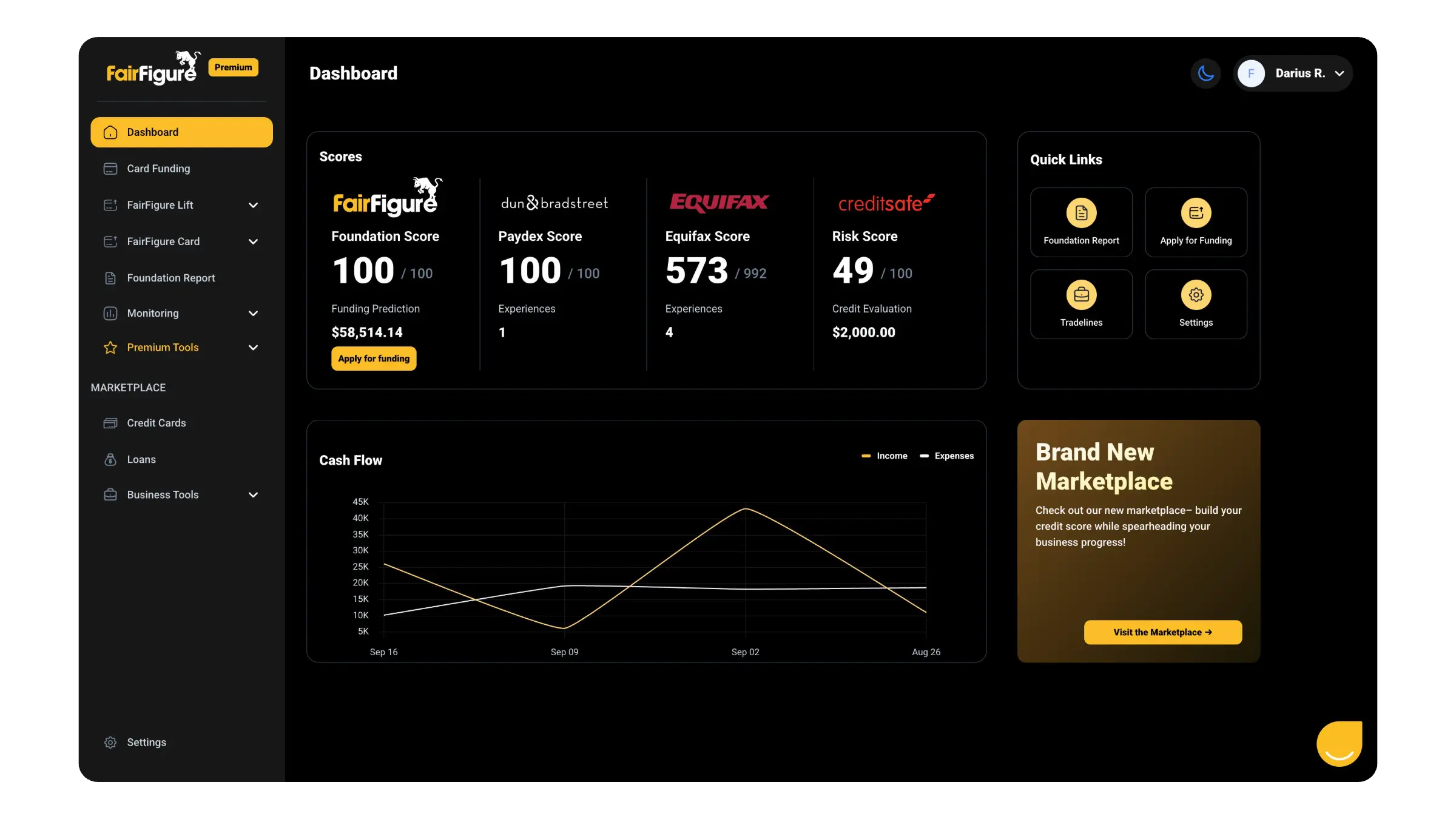

As you build business credit with net 30 accounts, remember to review your business credit reports regularly to ensure you’re making progress. One of the best ways to do that is with FairFigure’s business credit monitoring service.

You can gain access to your Equifax and Creditsafe reports for free! If you upgrade to a paid subscription for just $30 per month, you’ll also unlock your Experian and TransUnion business credit reports plus two extra business tradelines!

We’ll grant you access to the FairFigure business credit card and report your activities on the account to the commercial credit bureaus along with your monthly subscription. Sign up for a FairFigure account today and join Wise Business Plans using our referral link! You can join Wise Business Plans using our referral link!

More articles

Read More >

January 23, 2026

5 min read

January 23, 2026

5 min read

January 23, 2026

3 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure