FairFigure Platform: Build Business Credit. Access Capital. Fast.

Our platform gives you visibility into your business credit, what's holding you back, and real funding opportunities. All in one place. With FairFigure, you move from confusion to clarity, from rejection to approval, and from waiting to winning.

Everything you need to take control of your business credit

Business Credit Reports Access

See the data lenders use to make decisions. FairFigure gives you instant access to your business credit reports so you can identify what's helping (and what's hurting) your approval odds.

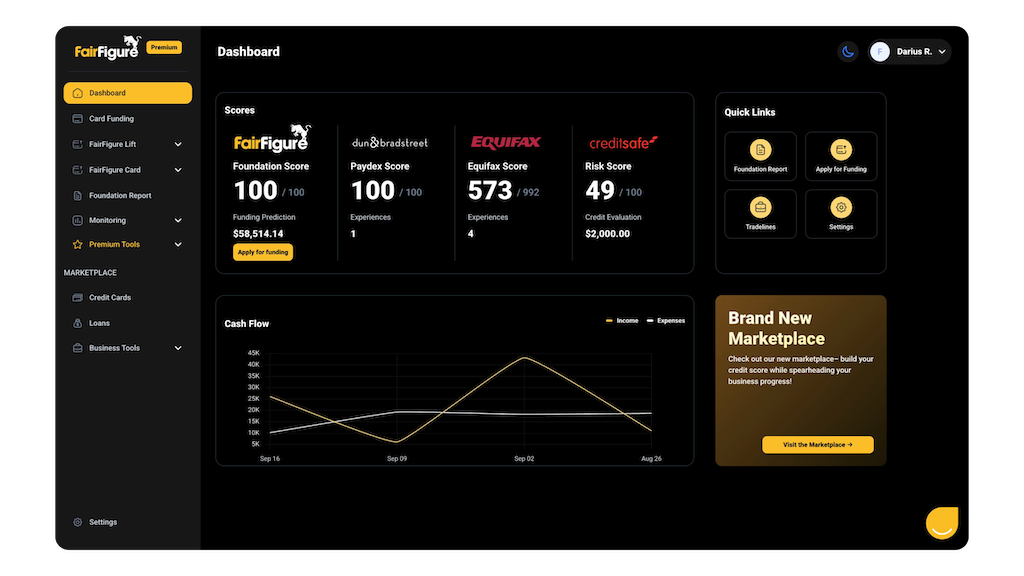

Business Credit Scores Access

Understand your credit health with verified scores from trusted providers like Dun & Bradstreet, Equifax, and Creditsafe.

Business Credit Monitoring

Stay ahead of surprises. Get alerts when your credit profile changes so you can act fast before it affects your financing options.

Unify

If errors or incorrect data are dragging your score down, the Corrector helps you find, fix, and dispute inaccuracies directly: restoring your reputation with lenders.

Pulse

Our AI-powered audio tool delivers personalized insights about your credit, cash flow, and financing readiness. So you can learn on the go, in minutes.

Signal

FairFigure scans the dark web to alert you if your business identity or sensitive data appear in breach databases, helping you act before criminals do.

Compare Plans

From rejection to readiness

FairFigure was built for small business owners who've heard "no" too many times. We help you understand why, fix what's broken, and finally qualify for the capital your business deserves.

Start free today. Build credit. Unlock funding.