Author: Dylan Buckley

October 07, 2025

9 min read

TABLE OF CONTENTS

- 1. Use Your DUNS Number on the Credit Card Application

- 2. Does the Credit Card Report to Dun & Bradstreet?

- 3. Does the Credit Card Report to the Personal Credit Bureaus?

- 4. Other Ways to Use Your DUNS Number

- 5. How to Build Business Credit with Your DUNS Number

- 6. Build Credit & Get Financing with the FairFigure Card

Start your credit building journey for your business

Learning how to get business credit card with DUNS Number is simple. In this guide, we’ll show you the ins and outs of using your DUNS Number to secure business credit cards.

Use Your DUNS Number on the Credit Card Application

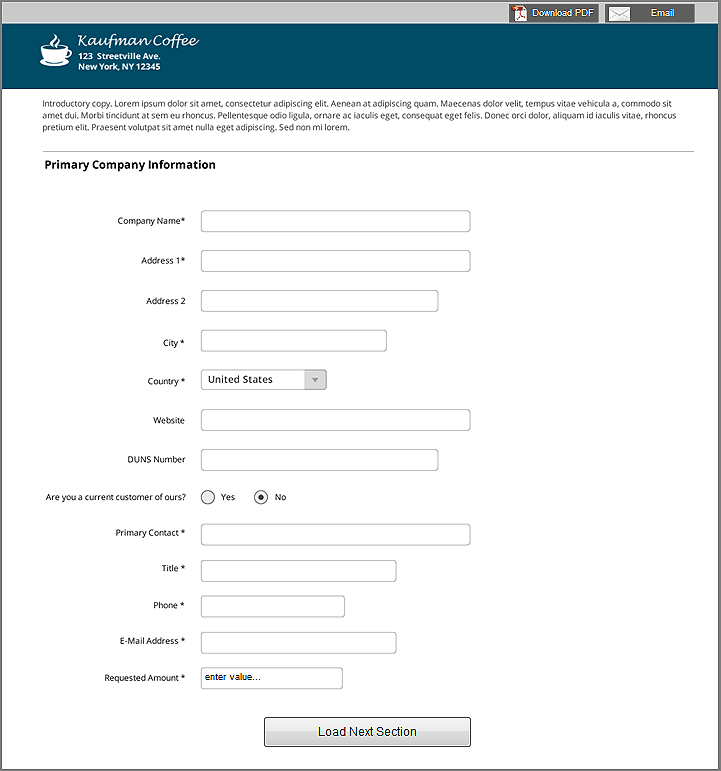

Many lenders will ask for your DUNS Number. Your DUNS Number tells them more about your business credit history, business credit score, and overall credit health via your Dun & Bradstreet business credit profile.

If you have a credit card application that asks for it, you can use it there. Dun & Bradstreet shows you what this may look like below:

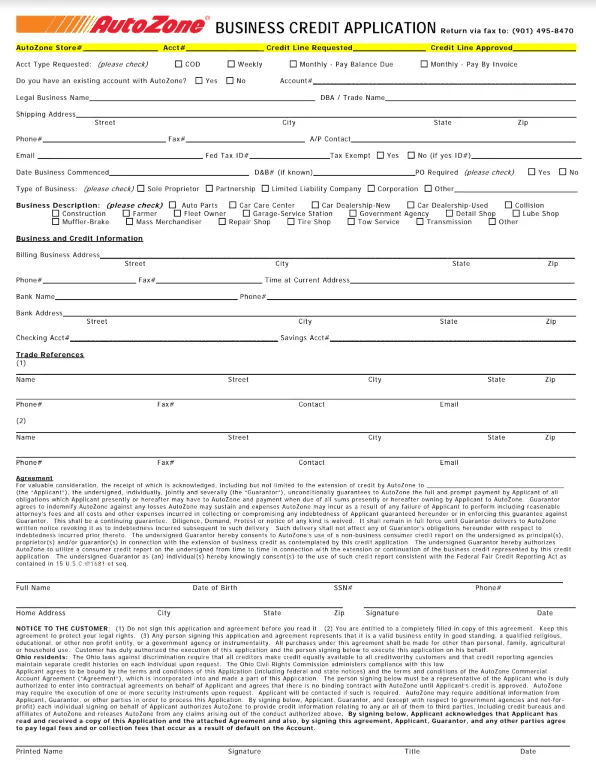

Here’s an example of it in action:

In some cases, a business credit card issuer may not ask for your DUNS Number on the application. If card issuers ask for it after you apply, you can give it to them then.

One common question business owners have is: Is the DUNS Number the same as an EIN? These are two different numbers. Your employer identification number is a number used to identify you that’s provided by the IRS.

Your DUNS Number is tied to your D&B business credit profile.

Do not treat them interchangeably. Take care to make sure you’re using the right numbers in the requested sections.

Getting a DUNS Number is simple. All you have to do is:

- Visit the Dun & Bradstreet credit agency website.

- Tell them about the type of business you run.

- Provide them with more information about your business.

- Validate your information with a Dun & Bradstreet representative (if necessary).

- Wait for your DUNS Number to arrive. You can go about this process for free. It can take up to 30 days for processing. You could also expedite the process and get your DUNS number in up to eight days with a $229 fee.

Does the Credit Card Report to Dun & Bradstreet?

Terms, interest rates, and rewards aren’t your sole focus with business credit cards.

You also want to make sure that your business credit card builds business credit.

Not all business credit cards will report to Dun & Bradstreet. They may report to only one major credit bureau. This can help you build your business credit score and positive credit history. However, it won’t bolster your Dun & Bradstreet profile.

Which cards report to Dun & Bradstreet? Here’s a convenient table that will help you apply for the right cards.

| Bank | Does It Report to D&B? | Does It Report Elsewhere? |

|---|---|---|

| American Express | Yes - defaults only | Equifax, Experian |

| Bank of America | Yes | Equifax, Experian |

| Capital One | Yes | Equifax, Experian |

| Chase | Yes | Equifax, Experian |

| Citi | Yes | Equifax, Experian |

| U.S. Bank | Yes | No |

| Wells Fargo | Yes | Equifax, Experian |

Keep in mind that this is always subject to change. Whether it’s unsecured or secured business credit cards that report to D&B now, they may not in the future.

Always conduct further research to make sure they still have the same reporting practices. Take care to look into corporate card issuers and fleet card issuers to see if they report to a credit reporting agency as well.

This will ensure you have the desired impact on your business credit scores.

Does the Credit Card Report to the Personal Credit Bureaus?

One unexpected consequence of business credit cards is personal credit reporting.

It’s largely expected that your personal credit will be affected when they check your SSN.

But did you know that many business credit cards report to personal credit bureaus, too?

In many cases, business credit cards only report negative activity. This generally isn’t an issue when your accounts are in good standing. However, if your business faces hardship, your business card could affect your personal credit.

This could have a massive effect on your personal credit report that’s hard to recover from.

Some report positive card activity as well. While this may seem like a useful way to build good credit, it presents problems.

With a business credit card, the goal is to use your full credit line. Doing so poses no issue when it comes to your business credit. You can maintain a good business credit score with high utilization.

However, the jump in credit utilization could prove problematic for your personal credit.

Both positive and negative reporting can affect your positive credit report. You don’t want your payment history or credit utilization to be impacted by your business activities.

So, which business credit cards could affect your personal credit? Here’s an overview of popular business credit cards and if they report.

| Credit Card Issuer | Does It Report Positive Activity? | Does It Report Negative Activity? |

|---|---|---|

| American Express | No | Yes |

| Bank of America | No | No |

| Capital One | Yes (Except for Spark Cash Plus and Venture X Business Card) | Yes |

| Chase | No | Yes |

| Citi | No | No |

| Discover | Yes | Yes |

| U.S. Bank | No | No |

| Wells Fargo | No | No |

Other Ways to Use Your DUNS Number

There are many other uses for your DUNS Number beyond securing business credit cards.

Other ways you could use your DUNS Number include:

- Applying for net 30 vendor accounts. These enable you to pay later for various supplies and products your business might need. Trade credit can help you build business credit. We’ll cover this in greater detail in the section below.

- Improving or establishing working relationships with other businesses. A DUNS Number can prove how reliable you are. Your credit profile reveals your payment history, business health, and more.

- Applying for a small business loan. The SBA will ask you for your DUNS Number. While not required, it may also be useful for a business line of credit.

- Using your DUNS Number to get an SSL Certificate. This can expedite the approval process.

- Accessing government contracts and grants. A DUNS Number may be required in these applications as well.

- Creating an iOS developer account. This is actually required by Apple. If you plan on developing an app or are in the business of doing so, you’ll need a DUNS Number.

A DUNS Number can help you do so much more than just get a business credit card. Look into the various ways a DUNS Number will support your business activities and needs.

How to Build Business Credit with Your DUNS Number

Business credit cards that report to D&B can help you build strong business credit and payment history.

That being said, your primary focus in the beginning will likely be net 30 accounts.

Vendor tradelines are the perfect place to start because they’re easy to qualify for.

You choose a vendor that offers a net 30 account. You sign up. Then, you’re able to make a purchase and pay your bill later. Hopefully, your vendor will then report your payments to every major business credit bureau.

There are some things to note prior to applying for net 30 accounts.

- Not every vendor reports your payment activity. The Amazon net 30 account is a great example. Check to see that your payments are getting reported. Otherwise, your net 30 account won’t benefit you much.

- You can start building credit faster by making payments early. Early payments will help you reach higher D&B credit scores. Pay off your bill immediately. Or, look for net 60 or net 90 accounts that will give you room to make early payments.

- The goal of net 30 accounts is to serve as a foundation to access better funding opportunities. Start looking into tier 2 business credit vendors once you’ve built your business credit up to a sufficient point.

Building business credit doesn’t have to be challenging. One seamless way to build business credit is with the support of FairFigure.

Build Credit & Get Financing with the FairFigure Card

Looking to build business credit and access funding when you’re first starting out? The FairFigure Capital Card is the perfect solution for small businesses like your own.

The FairFigure Capital Card is accessible to you with a subscription to our business credit monitoring services. The FairFigure Capital Card supports you with:

- An EIN-only business funding solution. The FairFigure Card is a true business card with EIN only. No worries about personal credit checks holding you back. There’s also no personal guarantee, and no paperwork!

- Extensive credit reporting. Both your FairFigure subscription and card transactions are reported to the SBFE, Equifax, Experian, and Creditsafe. You get to monitor your business credit report, fund your business, and build credit with two tradelines!

- Flexible repayment terms with your credit account. You get to choose whether you pay your balance every four weeks or eight weeks.

- Cash back on eligible vendor purchases.

- A credit limit that increases as your business revenue does. The FairFigure Capital Card is revenue-based. This makes it easier for you to secure financing for your business. It also helps you boost your cash flow with an increasing credit line over time.

- Easy-to-meet qualification requirements. If you have a business that’s at least three months old and generates at least $2,500 in monthly revenue, you can get your hands on the FairFigure Capital Card.

Build your business credit and access financing that will propel your business forward with FairFigure. Register for an account today!

More articles

Read More >

December 05, 2025

12 min read

December 05, 2025

9 min read

December 05, 2025

11 min read

Start your credit building journey for your business