How FairFigure’s Foundation Report and Score Work

Author: Dylan Buckley

January 09, 2026

2 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Raw business credit reports present a major problem for the average owner: they have too many data points.

In fact, on average they have about 1,600 lines of data. While you could go through all of that and unpack it yourself, it’s much easier to read it packaged and redesigned into a singular, neat report.

That’s why we designed the Foundation Report and Score.

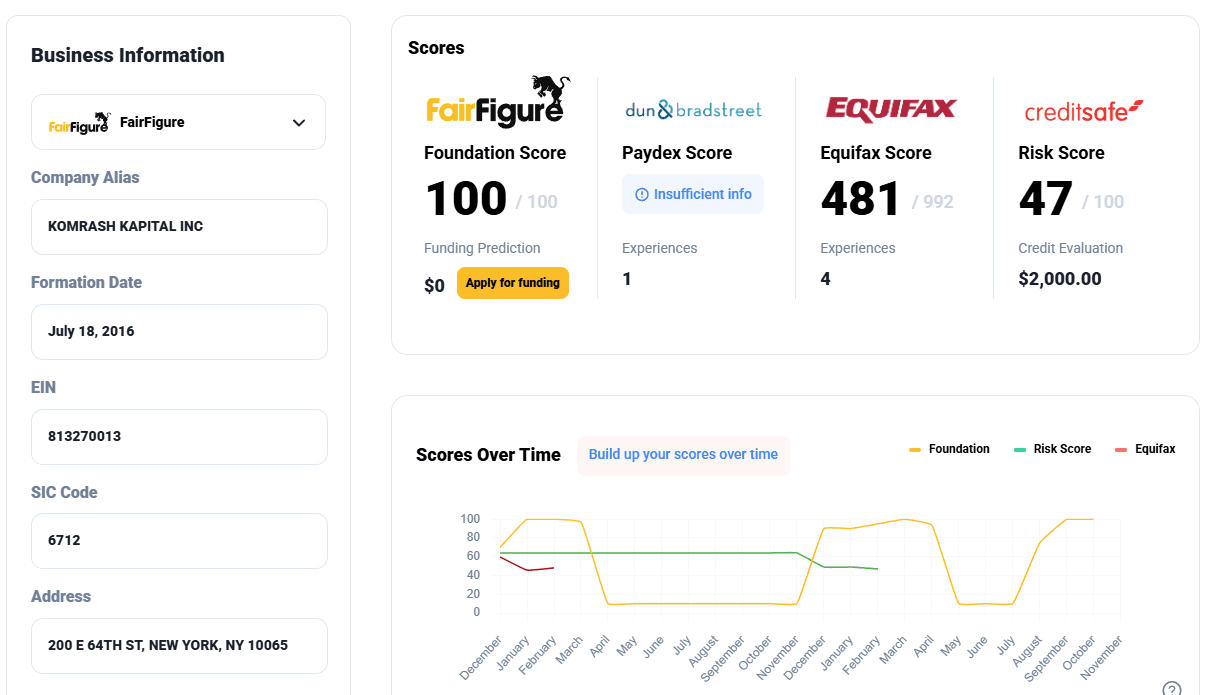

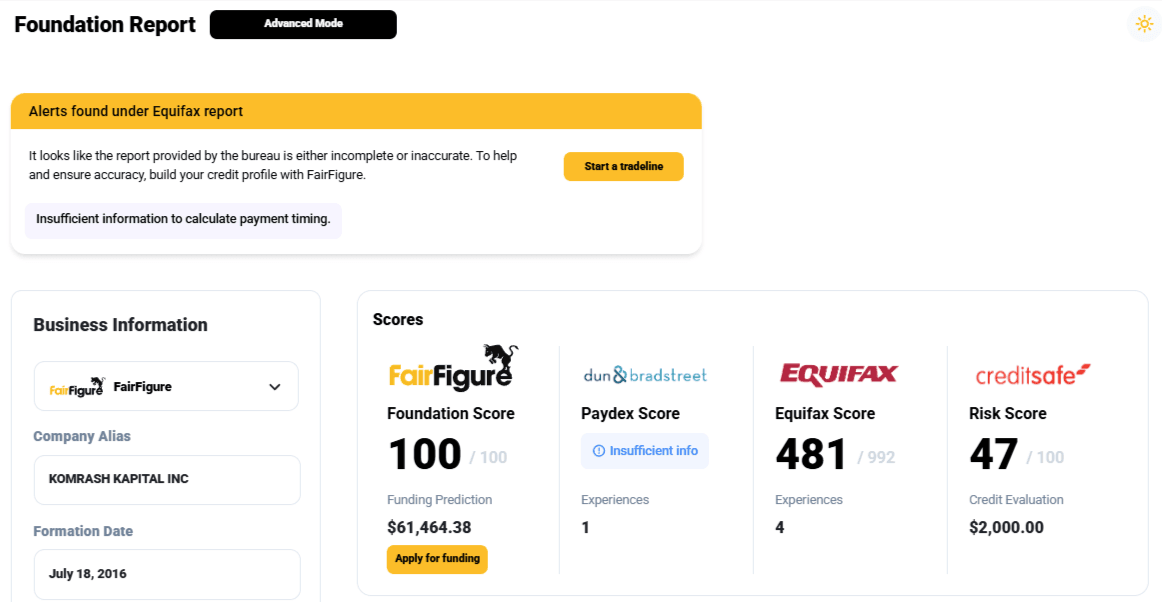

The FairFigure Foundation Score is calculated using tri-bureau data (D&B, Equifax, and Creditsafe) and your business’s revenue.

This is an innovative approach for two reasons. First, business credit bureaus normally don’t use data from each other, and the Foundation Report looks at your data from multiple bureaus.

Second, business credit bureaus (and hence their scores) don’t use checking account-based business revenue and expense data. FairFigure does. It checks your business’s income and expenses by connecting to your business’s checking account.

This information is combined with the credit bureau data to create a comprehensive Foundation Score.

What your FairFigure Foundation Score tells you is how fundable your business is. The higher your score, the higher the likelihood that you’ll be approved for financing and loans.

You’ll also find a Funding Prediction. This provides you with an overview of how much financing you could expect to tap into.

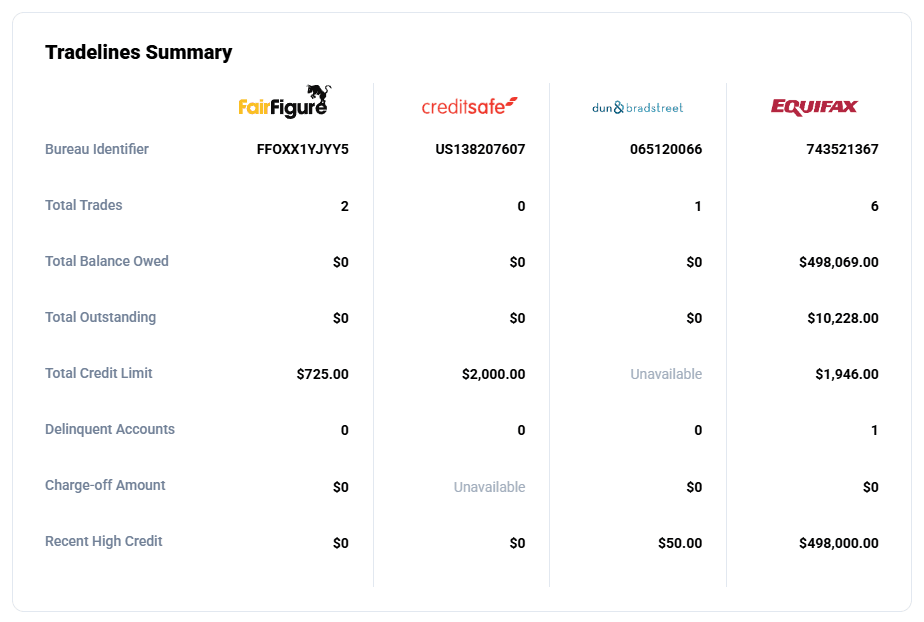

We’re quite transparent with the FairFigure Foundation Report. We offer insights into your tradelines:

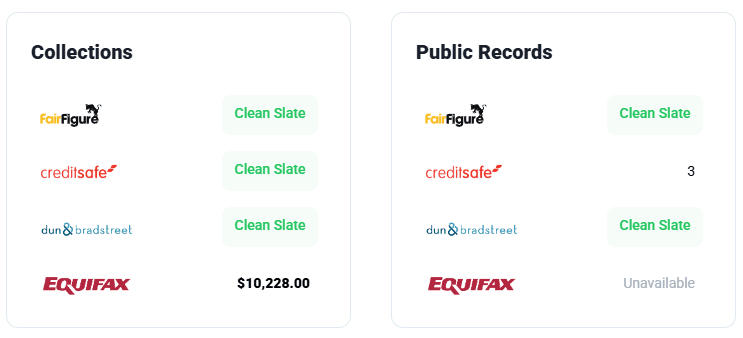

We offer insights into your collections and public records:

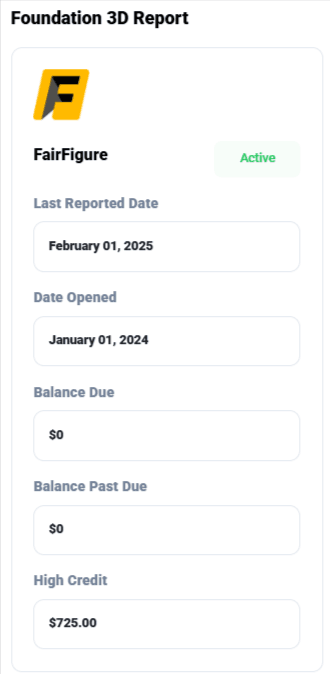

And we feature the Foundation 3D Report:

We also released FairFigure Advanced Mode earlier in 2025. This enables you to dive deeper into your commercial data set and export it, allowing you to use your data as you see fit.

You can find “Advanced Mode” at the top left of the Foundation Report dashboard:

More articles

Read More >

February 12, 2026

1 min read

February 12, 2026

1 min read

February 12, 2026

1 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure