8 Best Net 30 Accounts for Electronics: Easy Approval Vendors

Author: Nick Mann

January 23, 2026

13 min read

TABLE OF CONTENTS

Start your credit building journey for your business

A net 30 account is a win-win for business owners.

It gives you 30 days to pay an invoice to boost cash flow. And as long as a vendor reports to at least one credit bureau, it can improve your business credit history.

In this list, we’ve compiled our top eight net 30 vendor accounts for purchasing electronics.

The Best Net 30 Accounts for Electronics

- Amazon Business

- Best Buy

- Newegg Business

- Uline

- Crown Office Supplies

- Quill

- Lenovo

- Monoprice

1. Amazon Business

Officially known as Amazon Business Pay by Invoice, this is Amazon’s version of a net 30 account that gives business owners up to 30 days to pay. Note that Amazon offers even longer payment terms to individuals with a Business Prime Membership.

Small business and medium-sized business owners can get a 45-day credit term, while enterprises can get a 60-day term.

This provides businesses of all sizes with a simple way to free up cash flow with no minimum purchase while having access to one of the largest electronics catalogs in the world.

Amazon doesn’t publicly disclose its exact eligibility requirements, but many businesses should qualify as long they have reasonably good business credit.

The main downside when compared to many other net 30 vendor accounts is that Amazon does not report to any business credit bureaus.

This means a positive payment history won’t raise your business credit score. But if you simply want to extend your payment terms and use Amazon frequently for electronics purchases, it can still be a good net 30 account option.

2. Best Buy

When it comes to buying electronics, the first brand that comes to mind for many business owners is Best Buy. From laptops to tablets to printers to headsets, Best Buy is a true one-stop shop.

It also has a solid net 30 program and offers net 30 terms via its Business Advantage card.

The application process is straightforward.

Sign up for a Best Buy business account. From there, you can apply for a Business Advantage card.

If approved, you have 30 days to pay an invoice and get several other perks, like free shipping with no minimum purchase, daily deals and savings, and volume purchasing. You also have access to a wide array of office supplies, and Best Buy has 24/7 customer service.

As for credit bureau reporting, Best Buy doesn’t openly state who it reports to. However, it’s likely that it reports to at least one of the three major bureaus: Dun & Bradstreet, Equifax Business, and Experian Business.

3. Newegg Business

Founded in 2001, Newegg has solidified itself as a major American online electronics retailer. It boasts a massive inventory, carrying computers, servers, TVs, and much more.

While not as extensive as giants like Amazon and Best Buy, Newegg still has nearly everything a small business could need.

Applying for a net 30 terms trade credit is simple. As long as you have a registered Newegg business account and you are the primary account holder, you can apply. After doing so, you’ll be notified if you’re approved within 3-5 business days.

When it comes to reporting, Newegg reports to two of the three main business credit bureaus, Dun & Bradstreet and Equifax Business.

There’s also no minimum purchase amount, and it comes with perks like centralized account management and streamlined invoice management. Newegg also gives you the opportunity to increase your credit limit as you establish a positive payment history.

And we love that Newegg offers frequent deals and sales, with some products being discounted at over 40% off.

4. Uline

Although Uline mainly specializes in shipping and packing supplies, it also carries office supplies and a handful of electronics, such as headphones, speakers, and power stations.

The electronics inventory won’t necessarily overwhelm you, but Uline can serve as a nice net 30 account to add to the mix for additional trade credit.

And if you plan on buying shipping or packing supplies, you’ll already be set up with Uline as a net 30 vendor.

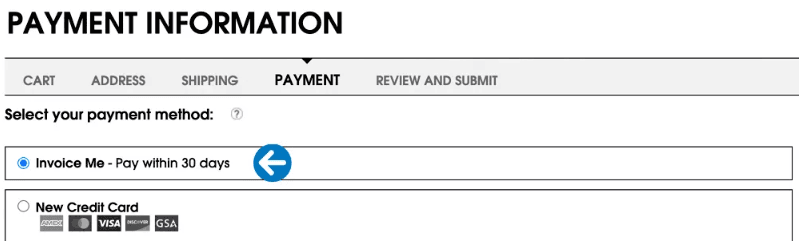

You can request net 30 terms by using your customer number during checkout. Simply select “Invoice Me” to do so.

There’s no minimum purchase required with Uline, and we love that it consistently has special offers, exclusive discounts, and even free offers when you hit a certain order threshold.

For reporting, Uline reports to Dun & Bradstreet and Experian, which can help raise your business credit history by consistently making payments on time. All in all, this makes Uline a solid choice for net 30 vendor accounts.

5. Crown Office Supplies

As its name suggests, this net 30 vendor focuses primarily on office supplies. However, it also carries a small amount of electronic products — mainly smartphone accessories and headphones.

Crown Office Supplies also says that it sometimes carries computers, but there are no products in stock as of the time of this writing.

While it’s not a wellspring of electronics items, Crown Office Supplies could serve as an additional net 30 account that could be helpful for building business credit.

Note that it usually takes 5-10 vendor tradelines to get the ball rolling, so Crown Office Supplies could potentially be a helpful vendor credit.

Applying for net 30 payment terms with Crown Office Supplies is easy, and you only have to provide basic information like your business name, organization type, employer identification number, and phone number.

This 30-day net term vendor also requires that you have at least 25% of ownership in your company, and you must spend at least $30 on an order for Crown Office Supplies to report your payment.

As for credit reporting, this net 30 vendor reports to Dun & Bradstreet, Equifax, and Creditsafe.

6. Quill

Here’s another of the net 30 vendors that doesn’t specialize in electronics (Quill focuses more on office and cleaning supplies), but it has a solid electronics inventory that should be sufficient for many business owners.

A few examples of what Quill carries include VoIP phone systems, power banks, charging kits, and speakers. And with frequent deals and discounts, you can find some nice savings while stocking your business with electronics essentials.

Requesting a net 30 account is straightforward. When checking out, select “Apply for Net 30 terms” and Quill will ask you to fill out a form with basic business information.

After filling it out, you’ll instantly know if you’re approved. If you’re approved, your order will promptly be confirmed and later shipped.

Otherwise, if you’re not approved, Quill will give you the opportunity to build a positive payment history by using a credit card and not having any late payments during a 90-day period. At that point, you will be reconsidered for a net 30 payment term.

Quill reports to Dun & Bradstreet and Experian Business, which are both important credit bureaus for improving your business credit report.

7. Lenovo

Lenovo is a major electronics brand that specializes in PCs, laptops, tablets, and servers. It has a well-stocked inventory with virtually everything a small business needs and offers frequent deals with steep savings of up to 50% off.

Lenovo has a robust net 30 account program, which can be easily set up and will give you an eligibility decision in one business day. Just note that you must first be a Lenovo Pro member before you can apply for a net 30 account.

If you aren’t yet a member, you can join for free here.

There is no minimum purchase when buying from Lenovo, and as long as you make invoice payments within 30 days you can raise your business credit score. And if you value a brand that prides itself on excellent customer service, Lenovo is right up your alley.

We also love that Lenovo reports to all three of the major business credit bureaus — Dun & Bradstreet, Experian, and Equifax. Put it all together, and this is pound-for-pound, one of the top net 30 accounts electronics.

8. Monoprice

Finally, there’s Monoprice, an online retailer that sells a wide variety of electronics, such as audio and video equipment, computers, cables, and mobile accessories for all of your business needs.

Here are some of the perks of buying from Monoprice.

You get a 30 day money-back guarantee with each purchase. There’s a lifetime warranty on all cable products and a one-year warranty on most other products.

You get top-notch customer service, with free lifetime tech support. There are also easy ordering features, business-centric promotions, and fast shipping.

When it comes to trade credit, Monoprice gives you 30 days to pay your invoices (there’s no minimum purchase). A credit application with this vendor is simple and can be done in just a few minutes.

As for credit bureau reporting, Monoprice doesn’t disclose this information, but it’s likely that it reports to at least one major business credit bureau. While it would be nice if it was a bit more transparent, we still consider Monoprice to be one of the more reputable vendors in the industry.

Alternatives to Net 30 Accounts for Electronics

Let’s say you’re not interested in any of these specific net 30 vendors. What are some other options for unlocking cash flow while also raising your business credit score?

First, you may want to consider vendors with different net terms, such as net 15, net 45, net 60, and net 90 terms.

A net 15 account would only give you 15 days to pay an invoice, but your payment history should be reported quicker, which should accelerate the improvement of your business credit history.

Longer net terms like 45, 60, and 90 days are nice because they give you extended time to make payments. Just note that it will typically take longer for your payment history to be reflected on your business credit file.

Another option is business credit cards. Just like a personal credit card where you typically have around a 30-day billing cycle, it’s the same with business credit cards.

So, by default, this gives you roughly the same length of time to make a payment, and your credit card payment history should be reported to credit bureaus, which should help improve your business credit score.

Besides that, you may want to consider a business loan or business line of credit, which also offers extended payment terms. Just note that you’ll likely need to be fairly creditworthy to be eligible for these forms of financing.

How to Build Your Business Credit with Net 30 Accounts for Electronics

There are four main things to keep in mind.

First, check to make sure a potential vendor reports to at least one major business credit bureau, such as D&B, Experian, Equifax, or Creditsafe. If not, your positive payment history won’t have any impact on your credit score.

Second, open multiple net 30 accounts, with a minimum of five vendors. We find that seeing tangible progress requires opening accounts with several vendors as opposed to just one net 30 account.

Starting with electronics vendors is a good place to start. But it’s smart to have net 30 accounts with vendors in other industries as well.

Some vendors we recommend include HD Supply, Strategic Network Solutions, Summa Office Supplies, Creative Analytics, and Wise Business Plans.

- HD Supply sells industrial products.

- Strategic Network Solutions offers business continuity and security services.

- Summa Office Supplies focuses on office products and cloud-based digital products.

- Creative Analytics offers growth marketing, design, and marketing automation services.

Just note that Summa Office Supplies and Creative Analytics don’t have quite as comprehensive services as some other vendors. We also put together this list of net 30 clothing vendors, if that's your industry.

As for Wise Business Plans, it offers a wide range of business plans, as well as market research. You can check out our Wise Business Plans net 30 review if you’re interested in learning more.

Also, it’s totally fine to stick with tier 1 business credit vendors initially. But try to branch out into different business credit tiers later on to continually build your credit.

Third, always make sure to pay every credit account on time or in advance. Just like making late payments on a personal credit card will harm your personal credit score, the same is true with a net 30 account. So it’s vital that you’re never late with a payment, not even once.

Finally, always stay on top of your business credit report to make sure all of your payments with net 30 electronics vendors are accurately reported.

Business credit monitoring should help you spot any discrepancies or issues. If you spot something like inaccurate late payments, you should resolve it right away so it doesn’t hurt your business credit history.

How FairFigure Can Help You Build Business Credit

Another way to quickly build business credit is with the FairFigure Capital Card, which offers a host of benefits.

Unlike many business credit cards that check your personal credit report or require a personal guarantee, FairFigure isn’t a traditional credit card and requires neither. Instead, we analyze your business data and provide an offer.

So if you’re concerned about poor personal credit getting in the way or simply want to separate your business and personal finances, this is the perfect card for doing so.

In terms of credit-building, the FairFigure Capital Card reports to multiple business credit bureaus and offers two tradelines for maximum results.

And by maintaining a responsible payment history, a dedicated funding advisor can work with you to potentially provide further financing offers in the future.

As for payments, FairFigure has 4- and 8-week payback options for plenty of flexibility that’s perfectly suited for your business needs.

Besides that, FairFigure offers the best-in-class business credit monitoring to ensure no issues negatively impact your credit score.

More articles

Read More >

February 12, 2026

1 min read

February 12, 2026

1 min read

February 12, 2026

1 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure