Our Summa Office Supplies Net 30 Review

Author: Nick Mann

January 23, 2026

6 min read

TABLE OF CONTENTS

Start your credit building journey for your business

With a sizable inventory and reporting to two major business credit bureaus, Summa Office Supplies Net 30 was a top net 30 vendor. Unfortunately, they’ve closed their doors and are no longer around.

For this post, we’ll discuss three similar alternatives that can help you build business credit while purchasing office supplies.

Former Summa Office Supplies Net 30 Offering

While other office supply companies like Office Depot, Office Garner, and Ohana Office Products have more extensive catalogs, Summa Office Supplies was a favorite among many small business owners.

The company carried office supply items like notebooks, legal pads, markers, erasers, flip charts, and more.

Small business owners could conveniently purchase many of the office supplies they needed with a net 30 account from Summa Office Supplies, while simultaneously building business credit by maintaining a positive payment history.

In terms of reporting, Summa Office Supplies used a two-tier system.

Its tier 1 net 30 account, which was easy to qualify for and had no personal guarantee, reported payment history to Equifax Small Business. And its tier 2 net 30 account, which had steeper eligibility requirements, reported payment history to Dun & Bradstreet.

Both tiers had a $2,000 credit limit, and business owners had to spend at least $75 for payments to appear on their business credit history.

When you combine the inventory line, relatively relaxed eligibility requirements (even for a tier 2 account), and solid credit limit, Summa Office Supplies was a leading vendor account for business credit reporting.

Again, this vendor credit account is no longer available, but there are a few comparable net 30 options that can help you build business credit.

Interested in using business plans to build business credit? Check out our Wise Business Plan Net 30 Review.

Alternative Net 30 Accounts

1. Quill

Quill is one of our favorite net 30 office supply alternatives for three main reasons.

First, it carries an extensive line of office supplies, including:

- Folders

- Sticky notes

- Envelopes

- Notebooks and binders

- Calendars

- Storage containers

- Staplers

- Paper shredders

- And much more

This makes Quill a one-stop shop for all your office supplies needs, and it also carries cleaning supplies, electronics, and packing supplies, for additional inventory.

Second, it reports payment history to two major business credit bureaus — Dun & Bradstreet and Experian Business.

Just as reporting personal payment history to multiple bureaus is important for building personal credit, the same is true when building business credit and it can help raise your business credit score.

Third, it’s one of the easier net 30 programs to qualify for, making it ideal for newer businesses. Even if you’re not approved for net 30 terms initially, you can be reconsidered after 90 days by completing Quill orders with a credit card.

Just note that this office products vendor requires you to make at least a $100 payment to qualify for net 30 terms. You can learn more and request a net 30 account here.

2. Uline

When most people think of Uline the first thing that comes to mind is shipping and packing supplies.

While these are the products Uline specializes in, it also carries a robust line of office supplies, including the following:

- Desk supplies

- Markers and pens

- Boards and easels

- Scissors

- Staplers

- Clipboards

- Envelopes

- Paper shredders

Uline also sells office furniture and industrial products similar to HD Supply, making it a true one-stop shop.

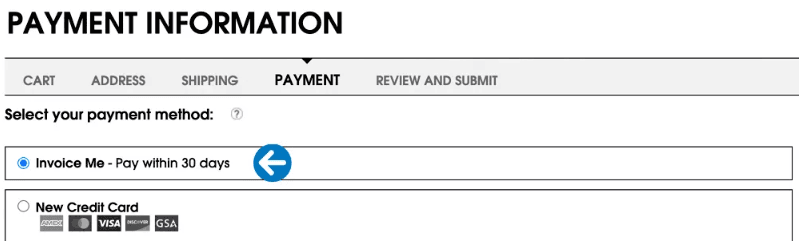

We like how easy Uline makes it to apply for net 30 terms. All a small business owner has to do is “use their customer number from the back of their catalog when prompted” during checkout.

Then, “select ‘invoice me’ during the checkout process. Qualified business customers will receive a net billing account, which allows for payment within 30 days of receiving the invoice.”

You can learn more about getting a net 30 term trade credit and enroll here.

There’s no minimum purchase requirement. As for business credit agency reporting, Uline reports to Dun & Bradstreet and Experian Business.

Also, note that most Uline customers are happy with its customer service, which is a nice plus.

3. The CEO Creative

While The CEO Creative doesn’t offer the same inventory volume as the previous two vendors with net 30 payment terms, it still has a solid selection of items like notebooks, folders, sticky notes, envelopes, and more. It also offers customizable apparel and even web and graphic design.

It’s one of the easier net 30 account programs to sign up for, and it caters to established businesses as well as new small business owners who are hungry to build business credit. You simply need to be US-based, have been in business for at least 30 days, and have a clean business history with no late payments.

There’s also no minimum purchase amount. As for credit bureau reporting, The CEO Creative reports to Equifax Business.

You can learn more and sign up here.

Boost Cash Flow and Raise Your Business Credit Score with FairFigure

Net 30 accounts can be extremely helpful for raising your business credit score. But they’re not the only option.

If you’re looking for business financing to increase cash flow while simultaneously building good credit, the FairFigure Card is an excellent choice and is one of today’s top tier 1 business credit vendors.

(We wrote about the four different business credit tiers. If you’re just building business credit for the first time, this is where you start.)

This card is EIN-only, meaning we don’t check your personal credit, and you can separate your business bank account from your personal account. There’s no personal guarantee or deposit required.

If you’ve been wanting a business card but are concerned about your personal credit holding you back, this isn’t something you have to worry about with the FairFigure card. Also, you select your own payback term, with four and eight-week options.

Plus, you get best-in-class business credit monitoring, along with two tradelines. Premium FairFigure members also have their payment history reported to credit bureaus to maximize their business credit impact even more.

That way, you not only get access to business funding to fuel growth, but you can build your business credit by maintaining a positive payment history while also keeping a close eye on your business credit health. Get the full details here.

More articles

Read More >

January 23, 2026

5 min read

January 23, 2026

5 min read

January 23, 2026

3 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure