Types of Business Credit Guide

Author: Dylan Buckley

December 04, 2025

8 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Looking to finance your business? There are a host of business credit solutions at your disposal. Knowing your options will allow you to make educated financial decisions regarding business financing.

We take a look at the many different types of business credit available to you.

1. Trade Credit

Trade credit or vendor credit is a type of business credit that every business starts out with.

You find a vendor that you wish to work with. You agree to make a payment in the future for the products that you purchase (often, net 30 terms). Then, they report your transactions to major business credit bureaus when you make on-time or early payments.

Unlike other business credit solutions in this guide, trade credit won’t support you with financing. However, it will help you build the credit history you need to tap into cash in the future.

When approaching any vendor offering trade credit, take care to:

- Pay attention to any fees that they may charge. Some accounts are free to sign up for. Others cost money. This may include sign-up fees, membership fees, and beyond. They may also require you to meet order minimums.

- Check and see if they report to business credit bureaus. Not all net 30 accounts report your transactions.

- Sign up for accounts you’ll use for everyday purchases. If you don’t use your account monthly, it won’t help you build credit.

2. Business Loans

There are several main types of business loans to seek out when you need funding. Whether you need capital for business operations as a whole or specific forms of financing, consider the following.

Term Loans

Term loans are one of the top loans to consider if you need working capital. Small businesses that qualify can use funds from term loans on a wide range of business expenses.

Term loans can get you up to $5 million in funding. Loan terms vary anywhere from six months to 7 years. APR will vary greatly depending on the loan terms. Traditional institutions, like banks, tend to have lower interest rates, somewhere around 6% to 12%.

Term loans from online lenders often feature much higher interest rates.

These types of loans are often more difficult for the average small business owner to qualify for. You’ll likely need a higher business credit score, more credit history, and strong revenue before you can acquire medium to long-term loans.

SBA Loans

If you need business financing, Small Business Administration (SBA) loans are a strong choice.

Businesses that meet SBA size requirements and eligibility requirements benefit from lower down payments, lower interest rates, flexible terms, and higher overall loan amounts.

More than that, specific types of SBA loans, like SBA 7(a) loans, can be used for a wide range of business needs.

As with term loans, SBA loans have strict eligibility requirements. The SBA loan application process takes longer, so it’s not the best choice for fast funds. You can expedite the process by applying with an SBA preferred lender.

Check your business credit and personal credit to see if you meet their requirements before applying.

Real Estate Loans

Real estate loans are designed to support companies looking to purchase land, purchase buildings, or construct buildings for income-producing purposes.

There are different types of real estate loans. If you want to generate income by purchasing office space or constructing your own business building, for example, you’d want a commercial real estate loan. If you’re a flipper, you might choose a hard money loan.

Real estate loans can vary from hard to get to relatively easy to acquire. Consider what type you need, research loan issuers and credit requirements, and make sure you have the budget for down payments and any unexpected expenses.

Vehicle Loans

Do you need vehicles to help your employees get around? Are you a logistics company planning on investing in a fleet of vehicles to offer transportation services? If so, you’ll be looking into vehicle loans.

Shopping for business vehicle loans is akin to shopping for consumer vehicle loans. Consider:

- Whether your business credit is high enough to secure the loan and loan terms you want.

- What your down payment will look like.

- How much funding you need for the number of vehicles you’re hoping to purchase.

- Which lender you’re hoping to get loans from (get preapproved).

- Which vehicle loans are best suited for your needs. If you need to fund a whole fleet, fleet loans are a better choice.

Equipment Loans

Businesses that require an extensive amount of equipment to operate can be costly. Thankfully, you can acquire additional funding in the form of equipment loans.

Equipment loans are generally easier to qualify for because your equipment serves as collateral. If you are unable to make payments on your financing, they’ll simply repossess your equipment.

Lenders will often work with business owners who have lower business credit scores. This makes it an accessible form of financing for new small business owners.

Equipment loans can reach up to $500,000. They often have one to five-year loan terms, and interest rates can range from approximately 4% to 25%. Expect to pay additional fees and a potential down payment.

Take care to get loan terms from your lender that don’t exceed the lifespan of the equipment you’re financing.

3. Revolving Credit

Revolving credit is stellar for business funding. You receive consistent access to funding that will help you afford everyday business expenses as well as bigger purchases. Here are the two types of revolving credit for businesses.

Business Credit Cards

Business credit cards are among the more accessible financing options for small businesses.

Businesses could get $50,000 or more in funding that they can use as they see fit. Of course, the type of business credit card you choose ultimately dictates your experience. When comparing business card options, consider the following:

- Avoid secured business credit cards. These cards are often accompanied by fees, security deposit minimums, and low rewards.

- If you want to avoid personal credit checks, look for EIN-only cards. Corporate cards and fleet cards are an excellent place to start.

- Find a credit card that meets your business needs. There are travel-focused cards, cards for everyday spending, and many more options to bolster cash flow and support your need for funds.

Lines of Credit

Business lines of credit are one of the top financing solutions out there.

A business line of credit comes with a myriad of benefits. They offer loan amounts of anywhere from $10,000 to $250,000 (or higher), low interest rates, and provide you with consistent funding and cash flow support until your draw period expires.

A business loan only gives you a lump sum; a business line of credit lets you draw as much as you want, pay it back, then draw from the full amount again.

A business line of credit is much harder to qualify for than a business credit card. You’ll need to work your way up to a business line of credit.

4. Alternate Credit

Alternate credit options are useful if you don’t qualify for traditional financing. Here are a few that you can leverage in your small business.

Merchant Cash Advances

Merchant cash advances will give you a lump sum in return for a portion of future credit and debit card sales. If you have strong, consistent credit and debit card sales, merchant cash advances can help you access quick funding.

The problem with alternative credit solutions is that they do come with their downsides. When looking into merchant cash advances, look out for:

- High factor rates, which can cost you a ton of money

- Potential cash flow problems stemming from repayment terms. This could lead to debt problems

- Additional fees

Invoice Financing

Invoice financing sees you borrow against unpaid invoices, then pay that amount back once customers have paid you.

Invoice financing is more accessible than other forms of financing. Lenders are more interested in the business or personal credit (and credit history) of your customers than yourself. Your invoices also serve as collateral.

However, it can involve high interest rates, short repayment terms, and is only available for B2B businesses.

That being said, it’s often better than invoice factoring, which is another alternative credit solution.

Equipment Leasing

Is a business loan for your equipment out of reach? Equipment leasing might be the solution.

Equipment leasing is often desirable because of low monthly payments, minimal upfront costs, and maintenance managed by the leasing company. Your equipment still serves as collateral, which means no personal guarantee.

The tradeoff is higher interest rates and a lack of equipment ownership.

It’s an option to consider alongside financing. Just take care to consider the disadvantages.

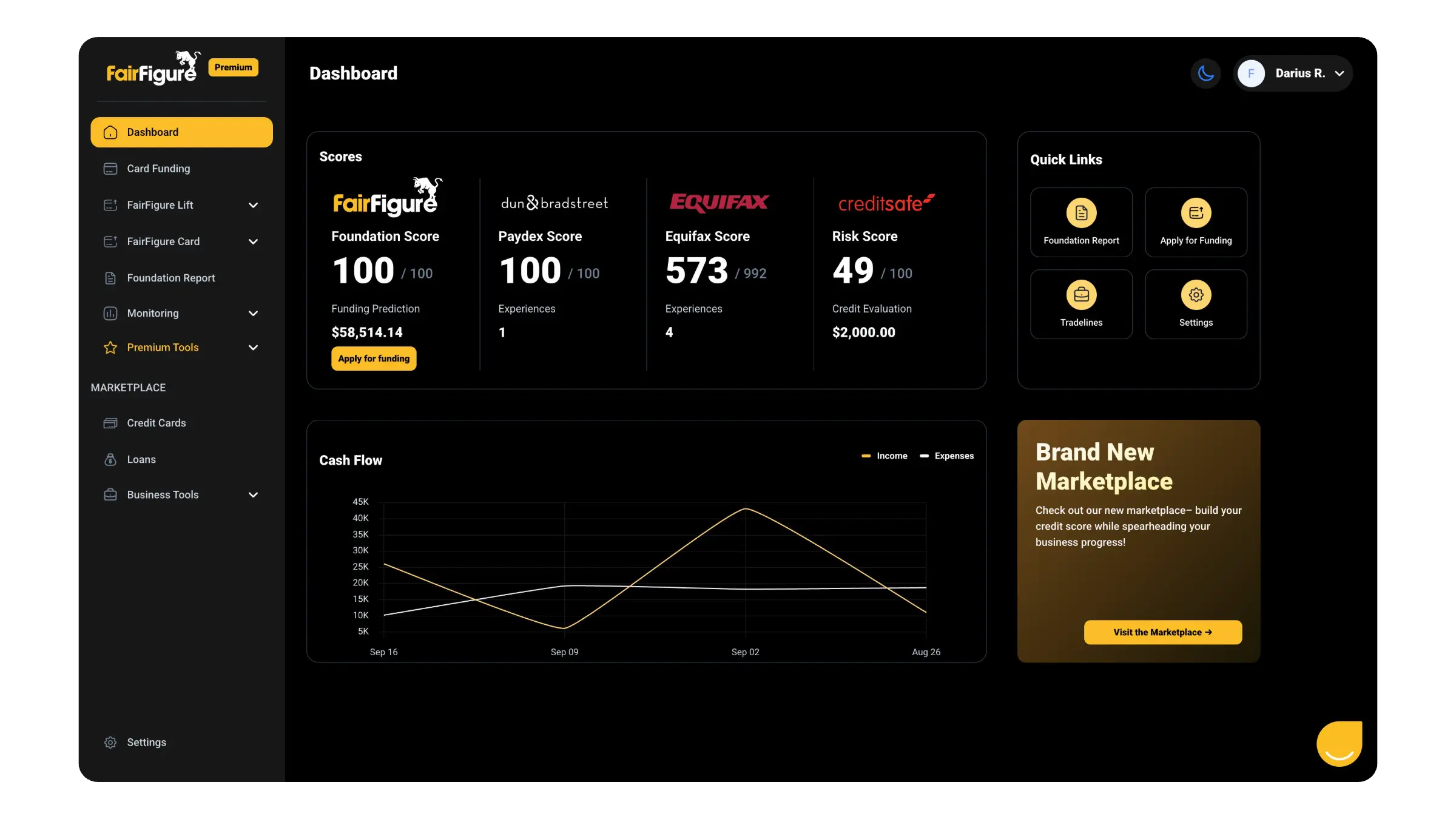

Build Business Credit with FairFigure

Many of the business loan and business credit solutions above require good business credit. If you need to build business credit, you can start here with FairFigure!

We act as your business credit builder in several ways:

- Tradeline Reporting: Your business credit monitoring subscription is reported as a tradeline to Experian, Equifax, the SBFE, and Creditsafe. It makes it easy for you to track your progress and fix mistakes where they arise.

- Business Financing: Our FairFigure Capital Card and FairFigure Lift Business Credit Builder Account help you fund your business and grow your credit. Take advantage of funding and a second tradeline with these solutions!

Make the moves needed to access better financing opportunities now. Sign up for FairFigure today!

More articles

Read More >

February 12, 2026

1 min read

February 12, 2026

1 min read

February 12, 2026

1 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure