The Top 7 Business Credit Building Companies

Author: Nick Mann

January 23, 2026

9 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Need to unlock business funding opportunities but have poor business credit?

Here are seven of the top business credit building companies that can be the catalyst for building strong credit quickly.

1. FairFigure

FairFigure can help a small business owner build business credit in three ways.

FairFigure can help a small business owner build business credit in three ways.

First, it features cutting-edge business credit monitoring, which allows you to see what lenders see.

Similar to Experian Business Credit Advantage, this can help you quickly identify errors or discrepancies with a free business credit report so you can take proactive measures to prevent your business credit score from taking a hit. FairFigure allows you to see your business credit report and score from multiple business credit bureaus, including Dun & Bradstreet.

Second, FairFigure serves as a tradeline. On-time payments are reported to major business credit bureaus, which helps build your small business credit score and strengthen your overall credit profile.

Third, you can use the FairFigure Card to gain access to additional business funding. Maintaining a positive payment history with this card also improves your business credit profile, which should make you more attractive to lenders.

Note that this is a business credit card with EIN only and doesn’t require a personal guarantee. This means your funding is based entirely on your business revenue rather than your personal credit score.

If you’re looking to monitor your business credit, build business credit, and unlock funding simultaneously, FairFigure can help you do all three.

2. eCredable

Almost every business owner makes some sort of utility payments, such as electrical, water, gas, and internet.

Almost every business owner makes some sort of utility payments, such as electrical, water, gas, and internet.

eCredable is a company that reports business utility payments, as well as business rent/lease, business insurance, and other services, to major business credit bureaus.

By simply making payments on time as you would normally, you can have them reported to at least one major business credit reporting agency for a significant boost to your business credit profile.

This makes eCredable one of the better business credit building companies for optimizing your business credit report without any heavy lifting.

And this is a breath of fresh air, given that it often takes 5 - 10 vendor tradelines to gain any real momentum with trade credit. Rather than having to be approved for multiple accounts, make payments, and wait to see the impact, eCredable streamlines the process dramatically.

In turn, this can put you on your way to establishing good business credit while saving time and money.

3. Credit Suite

Credit Suite is a holistic business credit builder and leaves no stone unturned in your quest to build your business credit history.

The process starts with a “fundability scan” that provides a detailed overview of how lenders view your business.

This encompasses what the company calls the five main principles of fundability, which include:

- Foundation

- Business credit

- Personal credit

- Finances

- Application process

After running the fundability scan, you can determine how fundable your business is based on a score ranging from 0 to 890.

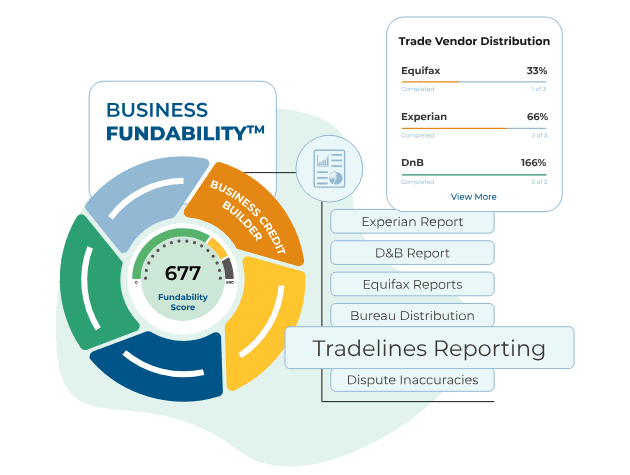

Source: Credit Suite

Source: Credit Suite

Besides that, they assess your company based on comprehensive fundability factors to help improve your fundability, build a better business credit score, and gain access to business financing like a business credit card, a corporate card, or a business line of credit.

In their own words, “We help you understand & improve over 125 Fundability Factors, establish and use your business credit, and match you with brokers and lenders to get loans and credit lines.”

If you’re looking for end-to-end assistance in improving your business credit with access to personalized coaching, this vendor is worth serious consideration.

4. The CEO Creative

Source: The CEO Creative

Source: The CEO Creative

The CEO Creative offers a net 30 vendor account for a wide range of products and services that are ideal for building credit.

Some of these include:

- Office supplies

- Writing supplies

- Apparel

- Electronics

- Tech products

- Web design services

- Printing services

Getting set up is straightforward, and you only need to meet a few criteria to be eligible for vendor credit.

You must be US-based, have been around for at least 30 days, and have a clean business history with no records of late payments. As long as you check all those boxes, you can join here and start shopping for products and services.

Just note that a $40 minimum purchase is required for The CEO Creative to report to a business credit bureau and the account has a $39 annual fee.

Purchasing from this company is a win-win because it gives you 30 days to pay an invoice, which can increase cash flow and give you some financial wiggle room. And, of course, with proper credit utilization, it can help you build business credit.

As long as you make payments on time your business credit history should improve.

5. Growegy

Source: Growegy

Source: Growegy

This is another net 30 vendor that gives you 30 days to pay invoices on digital tools and business services.

More specifically, Growegy offers “business operating software, AI content generation, business plan creation, project management, and marketing acceleration.”

One of the highlights of their tools is advanced generative AI that helps you create high-quality content from scratch.

From promoting your products online to creating a sales pitch to writing blog posts, Growegy can help you get it just right so you can spend time on more pressing business tasks.

In terms of building business credit, this company operates on the same premise as most other net 30 vendors. As long as you make payments on time or in advance, Growegy reports this to the major business credit bureaus — Experian Business and Equifax Business to be exact.

Over time, this should improve your business credit report and make it easier to qualify for other forms of business financing, such as business credit cards with a high credit limit and a business loan with favorable terms.

Note that Growegy doesn’t require a personal credit check, and their net 30 account application process is easy, as you only need basic information like an EIN and business address.

The only downside is that it costs $55 a month for a basic plan. And for an advanced annual plan you “make three interest-free payments (invoiced over three months) $200 per payment, then $0 for the rest of the year.”

You can see a full overview of the pricing structure here.

While it’s common for many business credit building companies to charge an annual fee, paying a monthly fee like this is substantially higher. So this is something to be aware of when considering signing up with this business credit builder.

6. JJ Gold

Source: JJ Gold

Source: JJ Gold

Before getting into the details of JJ Gold, it should be pointed out that their product line isn’t always practical for all small business owners.

For instance, some of their main products include:

- Hair and beauty

- Jewelry

- Home decor

- Eyewear

- Apparel

That said, there are certainly situations where some of JJ Gold’s products could be applicable. Entrepreneur-centric apparel, desk accessories, and wall decor are just a few examples.

The bottom line is that other vendors are more practical based on their product lines. But JJ Gold can still be a viable choice for some small business owners looking to strengthen their credit history.

As for how they can help you build strong business credit, JJ Gold offers a net 30 account to qualified businesses, where timely payments are reported to business credit bureaus.

Eligibility requirements are straightforward. You just need to operate in the US, have existed for at least 30 days, and have a clean business history with no late payments.

Note that a $80 minimum order is required to access net 30 terms on a credit line.

7. Wise Business Plans

Source: Wise Business Plans

Source: Wise Business Plans

As the name implies, this company specializes in business planning services.

However, they also offer services in several other areas, including:

- Business formation

- Business licenses

- Business website building

- Branding

- Market research

- Powerpoint presentations

If you’re a new business owner or simply need help in strategic areas of business development, odds are Wise Business Plans offers a relevant service.

Similar to Credit Strong, Wise Business Plans helps you build credit by offering a net 30 account and reporting payment activity to multiple business credit bureaus, including Experian Business, Equifax Business, and Creditsafe.

Signing up is simple. You just need to be a US business, have a valid tax ID, have filed as an entity with the Secretary of State, and not have any major business delinquencies.

There’s no personal guarantee, and you can separate your personal bank account and business bank account with a Wise Business Plans credit account.

As for minimum purchase, this company requires that you spend at least $164 to get net 30 terms and report payments.

This, admittedly, is higher than what many other companies require. But it’s still one we highly recommend if you’re looking for quality business planning services while working your way toward good credit.

Wrapping Up

From business credit monitoring to an EIN-only business credit builder card to reporting business utilities to net 30 accounts, there are a plethora of ways to go from poor credit to strong credit.

And once you gain momentum, you can use it to further build your business credit to become eligible for even more business financing opportunities from banks and credit card issuers.

More articles

Read More >

January 23, 2026

5 min read

January 23, 2026

5 min read

January 23, 2026

3 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure