Discover Business Credit Card No PG: Does Discover Require a Personal Guarantee?

Author: Nick Mann

January 23, 2026

10 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Hands down, Discover is one of the most popular business credit card providers.

But is it a viable choice if you want no personal guarantee to protect your personal assets and personal credit?

Let’s find out.

Does Discover Require a Personal Guarantee for Its Business Credit Card?

No, there is no Discover business credit card that doesn’t require a personal guarantee.

Currently, all of their business credit cards require a personal guarantee, which means you're personally responsible if you fail to repay your business credit card debt.

As a result, there’s a considerable personal financial risk — both to your personal assets and personal credit score.

Therefore, the Discover card is one that many business owners will want to avoid when considering a business credit card issuer, especially if they already have a bad credit history.

Fortunately, several other options besides Discover do offer no PG business credit cards, meaning your personal credit won’t be at risk in the event of a missed payment or default. Some even allow you to increase your credit limit later on by consistently making payments on time.

No Personal Guarantee Business Credit Card Options

1. FairFigure Capital Card

The FairFigure Capital Card is unique because it 1) doesn’t require a personal guarantee and 2) is one of the few startup business credit cards with no credit EIN only.

This means that instead of determining qualifications based on your SSN, it only uses your EIN for an account opening.

Rather than looking at your personal credit, FairFigure bases funding on your business revenue.

So if poor personal credit has been holding you back with someone like Mastercard International Incorporated or a national bank, the FairFigure Capital Card should be on your radar.

With it, you have the opportunity to get the critical funding you need to fuel business growth, while at the same time building business credit without bringing your personal credit into the mix.

This business credit builder card offers flexible repayment options, with four and eight-week plans. You get robust cash back rewards with card membership. And there’s the option of unlocking additional funding once you’ve proven that you consistently make payments on time.

On top of that, there’s no deposit required, and FairFigure offers top-of-the-line business credit monitoring, which can help give your business credit score an additional lift.

2. Ramp Corporate Card

The Ramp Corporate Card is technically a charge card, which means you don’t have to pay any interest. There’s also no personal guarantee or fees, which makes it one of the more appealing card offers.

With it, you get 1.5% unlimited cash back on all everyday purchases, which can add up quickly when frequently used for business expenses.

Plus, there’s a built-in expense management tool, which puts you in the driver’s seat for staying on top of business expenses and tracking cash flow.

And because Ramp automates many meticulous, redundant tasks like receipt coding and categorization, it can save your business time and money. In fact, Ramp says that the average business owner saves an average of 5% because of the increased efficiency.

We also like that it integrates effortlessly with over 200 apps, such as QuickBooks, Xero, and Sage, which can help save you even more time.

While the Ramp Corporate Card doesn’t have guaranteed business credit card approval, it’s one of the easier cards to qualify for. As long as you maintain at least a $75,000 cash balance, there’s a good chance you’ll be eligible.

3. Sam’s Club Business Mastercard

If you’re a business owner and also a Sam’s Club member, the Sam’s Club Business Mastercard can be a solid choice when you don’t want to deal with risking your personal credit.

Here are some of the more noteworthy features.

First, it has one of the better rewards programs. It’s nothing ridiculous like unlimited 15 cash back which breaks down as follows:

- 5 cash back on each eligible gas purchase for up to $6,000 per year

- 3% cash back on each eligible dining purchase

- 3% cash back on each Sam’s Club purchase

- Unlimited 1 cash back on every other eligible purchase

Next, there’s no annual fee. As long as you’re a Sam’s Club member, you don’t have to pay any extra for a business credit card account opening. Note that a Sam’s Club membership is $50 for the basic Club plan and $110 for a Plus plan.

If you don’t currently have a Sam’s Club membership, having this business credit card doubles as your membership card.

As for interest, as of April 2025, there’s a variable purchase APR of 20.90% or 28.90%, which means it’s, admittedly, not the best credit card if you want low interest.

4. Brex Card

If you’re looking for another great cash rewards business credit card, the Brex Corporate Card is right up your alley.

Here’s what you earn with it:

- “7x on rideshare

- 4x on Brex travel

- 3x on restaurants

- 2% cash back on software

- 1x on the rest.”

And because Brex partners with a lot of major brands, they offer additional perks like:

- Up to $5,000 in Amazon Web Services

- 3x back on eligible Apple products like Mac, iPad, and iPhone

- 30% off QuickBooks during the first year after account opening

- Various gift card offers

You can see a full overview here.

The Brex business credit card offers built-in spending limits so you can conveniently control how much employees can spend. It automates employee compliance for IRS tax reporting purposes. And it reports to Dun & Bradstreet, to help boost your business credit score when used responsibly.

By the way, we wrote an article about which business credit cards report to business credit bureaus, which discusses business credit history reporting in detail.

And if you’re interested in lenders that report to D&B, you can check out this list of secured business credit cards that report to D&B.

Although this is a corporate card, it’s very startup-friendly. So even if you’ve had trouble generating cash flow with another credit card issuer because you’re a newer business, Brex can be a viable option.

5. Mercury IO Card

This is a straightforward business card that’s also perfectly suited for startups.

The Mercury IO business card offers a simple cash rewards program, with 1.5% cash back on all purchases. While this isn’t anything over the top, we feel the cash rewards are still solid and there are no confusing nuances.

Mercury only has a low $25,000 cash balance minimum to qualify for this business card, making it ideal for newer-stage businesses. And because it acts as a charge card, there’s no interest or annual fees.

With it, you get comprehensive spend management tools to thoroughly track your company’s expenses with ease. This is a feature that many newer business owners can benefit from, as it takes the guesswork out of monitoring purchases and can help you scale your company.

It also integrates with several accounting platforms like QuickBooks and Xero to easily sync your financial data without any heavy lifting on your end.

We also like that Mercury offers instant virtual employee cards that you can send to your team members to fund purchases right away.

The bottom line is that Mercury IO is a respectable business card that can help improve your business credit history without having to deal with a personal guarantee.

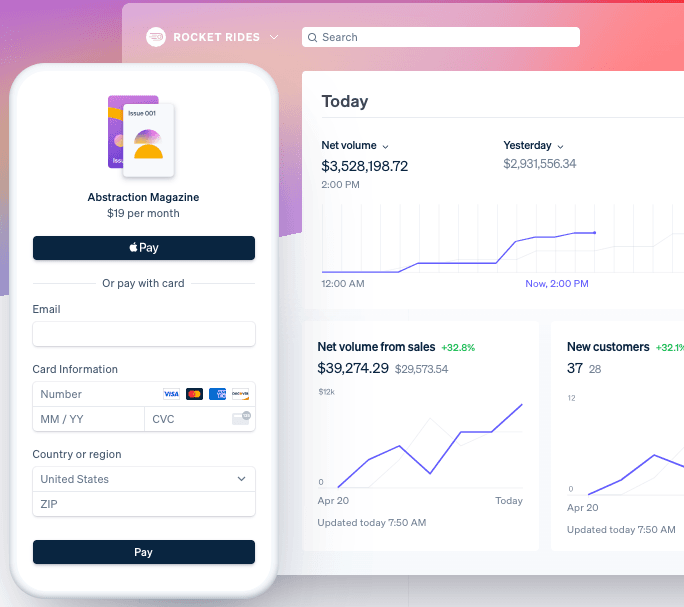

6. Stripe Corporate Card

If you’re already a Stripe user, the Stripe Corporate Card is a logical choice for a business credit card, as it seamlessly integrates with the platform.

We chose this because besides not requiring a personal guarantee, it boasts several other features and benefits most business owners will love.

First, it’s a straightforward business card with a solid rewards program. With it, you get 1.5% cash back on all purchases, along with rebates on certain business spending categories.

Like Mercury IO, there are no complications about guessing what rewards you’ll earn when using this corporate card.

There are no fees on anything — no annual fee, foreign transaction fee, or even late payment fee.

The Stripe Card also integrates easily with multiple accounting platforms, allowing you to conveniently sync your financial data. And you get detailed financial tracking and spending control to help you stay on top of your business finances.

Just note that you have to be a Stripe user and have a significant sales volume to qualify.

7. SVB Innovator Card

Our final business credit card comes from Silicon Valley Bank, or SVB.

In their own words, this is “a scalable business card that gives you more flexibility to manage purchases and payables. Help drive growth with a higher credit limit with no personal liability and robust spend controls.”

With the SVB Innovator Card, there’s no personal guarantee and no annual fee. It comes with expense management features to keep your business finances under control.

And it caters to startups with the potential for an increased credit limit over time.

Like Ink Business Cash, which offers up to 750 bonus cash on your statement credit, this credit card offer has an excellent rewards program, “where you can earn up to 3x on all purchases and receive up to 3,000,000 rewards points for the first six months or up to $1 million” — whichever comes first.

Just note that the offer expires after July 31, 2025.

FairFigure: The Smart Way to Build Business Credit

All of these cards are great for building business credit without putting your personal credit on the line.

That said, FairFigure may be the best option pound-for-pound, as it’s a true business credit card EIN only, offers detailed business credit monitoring, and also serves as a tradeline for a maximum impact on your business credit score.

Again, there’s flexibility with your payback terms, and you don’t have to deal with APRs. You just get reliable business funding without risking your personal credit.

Learn more about how FairFigure works and get started today.

More articles

Read More >

February 12, 2026

1 min read

February 12, 2026

1 min read

February 12, 2026

1 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure