Fair Credit Business Loans

Author: Dylan Buckley

January 09, 2026

12 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Is bad credit holding you back from financing your business? While excellent credit opens many doors, you can still fund your business with fair credit.

We look at the best fair credit business loans and the worst to help you explore and understand your options at this point in your business.

1. Revenue-Based Loans

The best way to secure financing with fair credit is to avoid credit requirements altogether. That’s where revenue-based loans come in.

Rather than extending financing based on creditworthiness, revenue-based loans consider revenue among other factors. These include time in business, financial stability and projections, and similar factors.

If you qualify for a revenue-based business loan, you’ll then receive a lump sum that you can use for whatever it is your business currently needs. For example, you might choose a revenue-based startup business loan to launch your business.

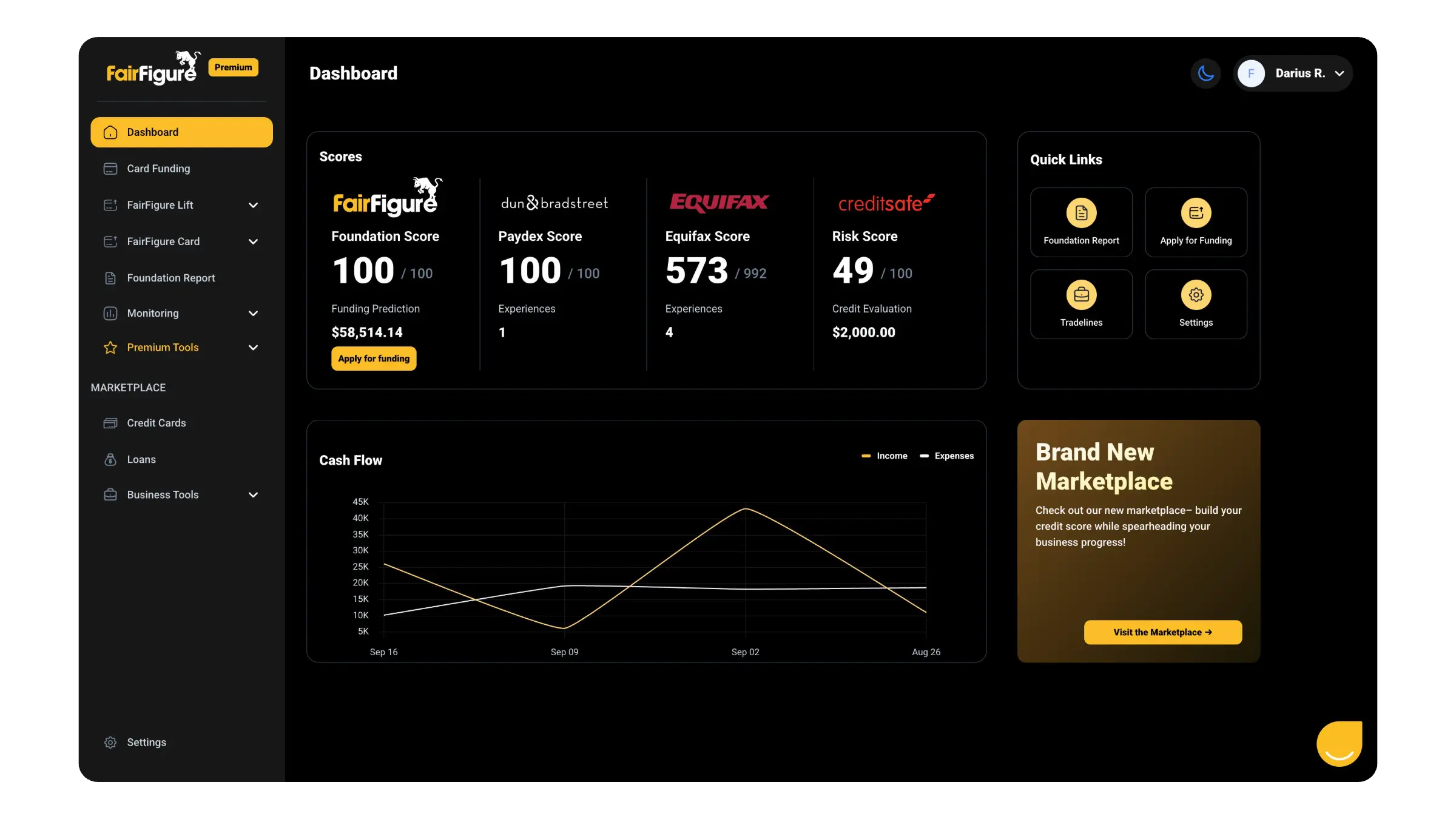

One solution worth turning to if you’re interested in revenue based financing is FairFigure Lift. FairFigure Lift is an EIN-only business credit builder account that helps you finance your business and build business credit at the same time.

The process is simple with FairFigure Lift. All you do is:

- Sign up for FairFigure Premium. Then, apply for FairFigure Lift. Business funding is based on your monthly recurring revenue. The more you generate, the more financing you can tap into.

- We deposit your funds directly into your linked business checking account.

- You make manageable, weekly repayments (paying over four to eight weeks), which are then reported to business credit bureaus.

- You can then access more business funding to support your cash flow needs.

All transactions are reported to Equifax Business, Experian Business, Creditsafe, and the SBFE. This helps you build your low credit score up over time so you can use your business credit score to tap into funding.

We also report to our own Foundation Report. This gives you insights into how much financing you might be able to access and how fundable your business is.

The best part is that your FairFigure Lift account is your second tradeline. Your FairFigure Premium subscription payment is reported to the same accounts above monthly.

Over time, you’ll see your hard work pay off with a higher business credit score and more funding opportunities.

FairFigure Lift is easy to qualify for. All you need is a positive business checking account balance, at least $2,500 in recurring monthly revenue, and at least three months in business. You can also apply again once you’ve paid off your loan!

2. Invoice Financing

Are you a B2B business with unpaid invoices and in need of a cash flow infusion? Invoice financing could be the right funding option for your needs.

Your credit doesn’t play a role in invoice financing because lenders aren’t looking for your creditworthiness.

Rather, your clients’ credit matters most. This is because they are the ones who are paying the invoices, which will ultimately mean repayment for the lender.

Invoice financing is a straightforward process.

You provide your desired lender with the eligible invoices. They extend you a lump sum business loan based on those eligible invoices. Then, as your clients pay those outstanding invoices, you pay your lender back.

Now, there are a few important things to know about invoice financing.

- Every alternative financing option has its advantages and disadvantages. In the case of invoice financing, you will often be dealing with higher fees. You are able to secure funding more easily with bad credit, but you can end up paying more as a result.

- If your clients don’t pay your invoice, you’re still on the hook. Make sure that your clients are reliable and will pay the invoices off. Otherwise, you’ll be required to pay the invoice, invoice fees, and any applicable late fees.

3. Merchant Cash Advances

Businesses that manage a high amount of debit card and credit card sales monthly can consider merchant cash advances if they have poor credit and limited financing opportunities.

With a merchant cash advance, you receive a lump sum business loan in return for an agreed-upon amount of your daily or weekly debit card and credit card sales. As such, you need to have relatively high, consistent revenue. Businesses with low sales won’t qualify.

Merchant cash advances can help you tap into quick cash when you’re having cash flow struggles. However, there are some drawbacks to note if you’re considering an MCA from an alternative lender.

- MCAs feature factor rates rather than interest rates. These can be high. For example, if you have a factor rate of 1.5 on a $10,000 merchant cash advance, you’ll be paying $15,000 back, plus any fees.

- MCAs won’t give you the same repayment terms as a loan or even a business credit card. You’ll often make automatic weekly or daily payments with a business cash advance.

- If you experience sudden issues in your business, it could easily lead to a cycle of debt and create further financial issues you were looking to solve by getting a merchant cash advance.

As with any funding opportunity, carefully weigh the pros and cons before applying for an MCA.

MCAs are the best fit for those with a high number of sales each month, who need quick access to capital, and don’t anticipate any serious financial obstacles or business interruptions anytime soon.

Business Loans that Are NOT Good for Fair Credit

Knowing what small business loan options are at your disposal now helps you understand what you can apply for. Still, if you’re doing independent research and exploring all of your options, it’s important to know what you’re not going to be able to depend on for financing.

Many alternative financing options either forego credit checks or are more lenient with bad credit. We’ve explored some of these options above. You don’t need a high credit score or extensive credit history to access business financing.

But you will need a good credit score for better choices.

Traditional financing solutions feature much more stringent qualification requirements. There are always exceptions to the rule.

However, you’ll likely find that you don’t qualify for many of these business loan options just yet if you have a bad credit score (until you build your credit or business credit).

What are these business loans that are not good for fair credit? Here are three that you’ll find challenging to acquire at this point in your business.

SBA Loans

SBA loans are a great resource for small businesses. It’s in the name. But an SBA loan is not easy to qualify for.

The SBA business loan application process is comprehensive, the qualification requirements are stringent, and it can be easy to find yourself turned away.

Let’s imagine that you want to apply for an SBA 7(a) loan. An SBA 7(a) loan will require you to:

- Have a score of at least 650. Many lenders may be looking for a credit score of at least 680 or even higher. Lenders are able to set their own credit requirements for your desired business loan. They’ll likely require you to have a higher credit score to qualify.

- Meet the SBA small business size requirements.

- Not be an ineligible business.

- Must not be able to get the desired credit on reasonable terms from non-local, non-state, or non-federal sources.

You will have to build up your credit score before you’ll be able to apply and get approved. Once you have a stronger chance of approval, make sure to work with an SBA preferred lender.

This will expedite the process as they won’t have to get approval from the SBA for your small business loan first.

Credit Cards

Traditional business credit cards are often harder to qualify for than most would think.

Generally, traditional business credit cards require good to excellent credit to qualify. Most cards won’t accept bad credit. This can leave out a lot of small business owners who don’t have the best personal credit score or credit history.

A great example of this is Capital One’s business credit card lineup. Almost all of Capital One’s business credit cards require you to have excellent credit. The only fair credit option is the Spark 1% Classic.

This does mean you can qualify for some cards. But as with the alternative solutions above, it does come with drawbacks. This card has a much higher 29.49% variable APR. You pay for bad credit with less desirable terms.

Right now, you could either focus on finding credit cards that accept poor credit or work on your personal credit score and business credit until you qualify. That being said, there are several alternatives worth considering.

- Corporate Charge Cards: Corporate charge cards tend to skip the personal credit requirements and look instead at revenue and other factors. Cards offered by Brex, Ramp, and Rho are all solid options if you want revenue based business credit cards.

- Fleet Cards: Do you own several vehicles that are crucial to business operations? Fleet cards like the Coast Fuel Card and the AtoB Fuel Card help you save on gas, maintenance, and more while offering you a traditional credit card alternative.

- The FairFigure Capital Card: The FairFigure Capital Card is a credit card alternative with no personal credit score check, no personal guarantee, no deposit, and no paperwork. It helps you tap into funding commensurate with your business revenue.

Many of these will also help you build your business credit score over time.

One other option that tends to get recommended for those with bad credit is a secured business credit card. These often result in guaranteed business credit card approval.

We don’t recommend secured business credit cards for several reasons. The biggest downside is that they have security deposit minimums and maximums. These will require you to pay a sizeable sum to access a credit line (or cap it if you have more you can put down).

These credit cards are known for their high fees and interest rates, which is another major disadvantage for the average small business owner.

You’re better off trying to find a traditional credit card you will be approved for with bad credit or choosing one of the alternatives listed.

Term Loans

When you’re thinking of business financing, chances are that your mind jumps to traditional term loans.

Traditional term loans are a great financing solution for small businesses. They’re defined by lower interest rates, flexibility, and access to large sums of funding at once. However, these types of loans are generally going to be available for the least risky business owners.

This is why you’re not likely to be able to obtain this kind of business loan with bad credit. A traditional lender (bank and credit union) is often looking for high credit scores that demonstrate financial responsibility and your ability to pay back the business loan.

They may also ask for proof of strong financial health, several years in business, and collateral, if you’re going after much larger term loan amounts.

There are term loans you may qualify for if you have bad credit. Online lenders are known to be more lenient with credit requirements if you’re in the market for a small business loan. You can get a bad credit business loan with them.

The tradeoff is that you then have to settle for higher interest rates, lower business loan amounts, and additional fees.

If you want to avoid the above, you’ll have to wait until you’re able to qualify for a traditional loan.

Build Business Credit to Get More Financing

The best way to access business financing is to build business credit. Established business credit history and high business credit scores unlock more opportunities. You’ll be able to rely less on your personal credit, which may be weighing you down.

That being said, not every small business owner knows how to build business credit without using personal credit. Figuring out where to start can be challenging. Signing up for FairFigure Premium streamlines the business credit-building process.

FairFigure’s business credit monitoring services and Premium subscription have a lot to offer. This includes:

- Business Credit Monitoring: Monitor your business credit to see your progress and catch issues quickly. Track credit reports and scores across Dun & Bradstreet, Equifax, Creditsafe, and the FairFigure Foundation Report.

- Access to a Wealth of Additional Services: Access additional services like FairFigure Guard, Pulse, and Unify.

- Business Credit Building: Your FairFigure Premium is reported as a tradeline. Every $35/month payment is reported to Equifax, Experian, Creditsafe, and the SBFE.

- Darknet Scanner: The darknet scanner works on your behalf to make sure that your personal info isn’t floating around on the dark web.

- Financing Opportunities: Grow your business with the support of the FairFigure Capital Card or FairFigure Lift.

- And More!

Securing small business funding with poor credit is possible, albeit with its fair share of concessions. Consider the fair credit business loan suggestions above to start funding your business.

If you want to fund your business with fewer concessions and build business credit along the way, register for FairFigure Premium now!

More articles

Read More >

February 12, 2026

1 min read

February 12, 2026

1 min read

February 12, 2026

1 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure