How to Build Business Credit Without Using Personal Credit

Author: Nick Alex Gallo

January 23, 2026

8 min read

TABLE OF CONTENTS

Start your credit building journey for your business

Building business credit typically involves leaning on your personal credit until your company can qualify for tradelines on its own. However, that requires taking on personal liability for company debts, risking your personal credit score and personal assets.

Here’s a step-by-step guide you can follow to build business credit without using personal credit, limiting your potential downside.

1. Establish Your Business’s Identity

To build business credit without using your personal credit, you need your company to have an identity of its own. To give it one, you should take various steps to make it appear increasingly separate from yourself.

Here are some of the most impactful ways to help accomplish this:

- Create a legally separate entity: Try not to operate as a sole proprietorship or partnership. A limited liability company (LLC) or corporation is preferable.

- Register for a business license: These are usually issued at the local level, either by your city or your county.

- Get a separate name and address: A brick-and-mortar location or a virtual office looks better than a P.O. box or UPS address. You can use your home address as a last resort.

- Open a legitimate business email: Don’t use an email that ends in Gmail or Yahoo. Create a business website and set up an email account that ends in its domain name.

- Get listed in a 411 directory: You can add your number to directories using websites like List Yourself. Landlines should get in automatically. Lenders often look for details like these when assessing credit applications to inform their opinion of your legitimacy. The more independent your company looks, the more likely it is to qualify for financing on its own, allowing it to build good business credit.

Some of the steps listed above are also common hard requirements. For example, many lenders won’t work with sole proprietors.

2. Obtain an EIN

Your Employer Identification Number (EIN) is a unique nine-digit number that functions like a Social Security number (SSN) for your business. In other words, it identifies your company for various purposes, such as when you’re applying for credit or filing taxes.

Not only does an EIN further establish your business as a separate entity, but it also helps you get business credit without relying on your personal credit. You can give it on credit applications to avoid involving your SSN.

You can request an EIN for free through the Internal Revenue Service’s digital tool. The process is quick, but be ready to provide your business entity type and SSN. Once approved, you should get your EIN instantly. We explain more about his in our article How to Use EIN Number for Credit.

3. Get a DUNS Number

A DUNS number is similar to an EIN but has more specific use cases. It is another nine-digit identifier, it comes from Dun & Bradstreet, a major business credit bureau alongside Equifax Business and Experian Business.

You may be asked for a DUNS number on certain credit applications, but it can’t replace an SSN. The primary benefit of getting one is that it tells the credit reporting agency it needs to open a business credit report for your company.

You can get a DUNS number online for free as well, but the process is slower than getting an EIN. You may have to wait up to 30 business days to receive yours after submitting a request. We go more in-depth in the article Is a DUNS Number the Same as an EIN?

4. Open a Business Bank Account

Opening a dedicated business checking account is another way to reinforce the separation between you and your company. It’s one of the primary signs that your business is operating independently.

In addition, many lenders won’t consider your credit applications unless you have one, especially those who use bank activity to inform their underwriting. Even some business credit rating models may lower your score without one.

Beyond credibility, a business bank account significantly streamlines your financial management and reporting. Identifying your business versus personal activities can be a pain when you commingle your funds.

5. Open Business Tradelines

A tradeline is a credit account that appears in your business credit reports. Fundamentally, they create the history that business credit bureaus use to calculate your scores. The more positive tradelines you have, the stronger your credit profile.

To open business tradelines without using your personal credit, target accounts that let you apply with your EIN. You want to stay away from those that require your SSN or ask you to sign a personal guarantee, especially if you have bad personal credit.

Typically, the best place to start is with vendor tradelines, also known as trade credit from suppliers. Vendor credit accounts are easier to get than financial tradelines—like a business loan—which come from traditional business financing issuers.

For example, net 30 accounts are a popular option, providing net 30 payment terms for invoices with a specific supplier. You can get them from tier 1 business credit vendors, like Quill or Grainger. They tend to have the most flexible lending requirements.

However, even vendor tradelines will often require you to use your personal credit if your business is new, lacks business credit, or isn’t established as a separate entity.

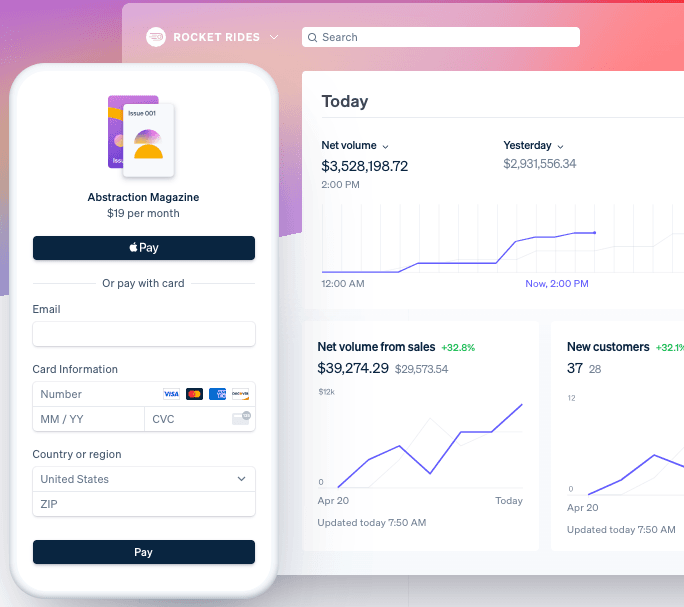

That’s where FairFigure comes in. With just one subscription, you can open two tradelines: one financial tradeline through the FairFigure Capital Card and one vendor tradeline through the subscription itself.

FairFigure is also a true EIN only business credit card. You won’t need to give your SSN, undergo a personal credit check, or sign a personal guarantee. Your business just needs $2,500 in monthly recurring revenue and three months of operating history.

6. Get a Business Credit Card

Business credit cards can be surprisingly easy to get as a new business owner, but only if you have good personal credit history and are willing to use it. If not, your business must have a well-established identity, financial position, and credit score of its own.

Even then, not all business credit card issuers will allow you to apply for an account without signing a personal guarantee. Typically, the best credit cards to target are gas or fleet cards and corporate credit cards, like:

- Shell Small Business Credit Card: This gas card lets you earn rebates of up to six cents back on your first 20,000 gallons of fuel from Shell per billing cycle. However, your business must be at least one year old and have $1 million or more in annual revenue to apply with your EIN.

- Stripe Corporate Card: This business card earns 2% cash back on your top two spending categories per month and 1% on all other eligible net purchases. There’s typically no hard credit check for the account, but you must be invited to apply because of your activities on the platform.

As you can see, business credit cards are harder to get than vendor tradelines without using personal credit. However, they’re often worth the effort, providing better cash flow management, a higher credit limit, and faster credit-building results.

7. Make Payments On-Time or Early

After account opening, nothing matters more for building strong business credit than how well you manage them. There are significant differences between business credit scores, but they all place a heavy emphasis on your payment history.

The most notorious example of this is D&B’s popular PAYDEX Score, which ranges from 1 to 100. Even if you pay on time without fail, your business credit score won’t exceed 80. To do better, you must make your debt payments up to 30 days early.

Other scores function more like personal credit scores, where payment history is a major contributor, but just one factor among many. For example, the FICO Small Business Scoring Service also considers criteria like credit utilization.

Ultimately, making timely payments is essential no matter what score you’re trying to improve. Consider setting your accounts to autopay immediately after credit approval to avoid costly mistakes.

8. Monitor Your Business Credit Reports Regularly

As you build business credit history a month at a time, stay engaged with your progress by monitoring your credit reports. The best strategy is often to use credit monitoring services, which provide access to your data and real-time updates when changes occur.

For example, they might notify you when they detect a new hard inquiry, missed payment, or drop in your score. These alerts can help you catch errors, threats, and signs of potential fraud early, so you can take action and prevent further damage.

Fortunately, on top of its credit-building benefits, FairFigure’s subscription includes free business credit reports, free business credit scores, plus personal and business credit monitoring.

Open a FairFigure account today for best-in-class monitoring and two additional tradelines with no personal guarantee or personal credit checks.

More articles

Read More >

February 12, 2026

1 min read

February 12, 2026

1 min read

February 12, 2026

1 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure