Does the Government Offer a Free Business Credit Report?

Does the Government Offer a Free Business Credit Report?

Dylan Buckley

•

March 27, 2025

•

7 min read

Personal credit reports are accessible for free. It’s mandated by the Fair Credit Reporting Act and enforced by a government agency, the Consumer Financial Protection Bureau.

However, the government doesn’t require that business credit reports be offered for free. You don’t have that same support.

That is, unless you register with FairFigure.

Here’s how FairFigure can help you stay on top of your credit health for free and why you should sign up for a subscription today!

Can I See My Business Credit Report for Free?

Small business owners need to be able to monitor their business credit to work toward better funding opportunities.

One might assume that you would be able to get your business credit for free. After all, you just need a little personal information to access a free copy of your personal credit report. However, this generally isn’t the case outside of consumer credit reports.

Many places that advertise free credit scores only offer your personal credit score. Credit scores and credit reports for businesses will require you to pay a small fee. There’s rarely a free report for businesses.

If there is, it may come with some caveats. Whereas you can get your personal credit report from a consumer credit agency regularly, you could go to D&B for a brief look (with additional features like a credit inquiry notification) for a limited time.

But that doesn’t mean it’s impossible to see your small business credit scores for free.

FairFigure offers a free business credit report. All that’s required from you is registration.

Once you create an account and tell us more about your small business, we’ll verify your business. Then, we'll provide you with a free business credit report and free business credit score information.

Whether you’ve been wanting to get your Equifax business credit report free or a report from one of the other major business credit bureaus, FairFigure will help you begin your credit building journey.

What To Look for on Your Business Credit Reports

Accessing your business credit reports won’t do much if you’re not sure what you should be looking for. Fortunately, these reports are fairly easy to understand.

Accessing your business credit reports won’t do much if you’re not sure what you should be looking for. Fortunately, these reports are fairly easy to understand.

No matter which credit report you’re accessing, always look at credit information like:

- Your Credit Score: Business credit scores don’t work like personal credit scores. Your business credit score will change depending on the type of score and the business credit bureau. For example, the PAYDEX Score from D&B features a score ranging from 0 to 100. It’s based on payment history. Then, you have scores like the financial stability risk rating from Experian. Each credit reporting company has different scores for you to leverage. Interpret and analyze your scores to get crucial business insights into the health of your business.

- Legal Events: Whether judgments, bankruptcies, or liens, a business credit report can tell you more about legal developments that may affect your credit. More than that, looking for these can make you aware of potential mistakes in your report.

- Payment History: Payment history is vital to good business credit. If you pay on time, you’ll keep your credit in good standing. If you pay early, you’ll see greater results when building your business credit score. Looking into your payment history on your credit report will help you recognize trends and potential mistakes.

- Financial Ratios: A credit report covers more than just your score. Business credit bureaus like D&B use financial ratios to produce business insights. Financial ratios like a debt-to-asset ratio can help bureaus understand how many of your assets are being financed by credit solutions, for example. Take a closer look at these if they’re on your credit file. They’ll give you a business credit advantage.

- Types and Age of Credit Accounts: Certain accounts like vendor tradelines need to be a major presence. You need at least 5 to 10 to see an impact on your credit. However, just one business credit card can have an impact as well. Making sure that credit progress aligns with the types of accounts you have is useful in identifying errors. Additionally, track how long your accounts have been open. The age of your accounts can impact your credit score as well.

- Missing Reporting: Mistakes aren’t the only things you should be looking for in credit reports. Sometimes, the owners of your accounts may fail to report, which will appear in your credit history as well. The point of opening accounts is to build good credit. If activity isn’t being reported by a creditor or financial institution, it’s not helping you at all. Carefully track transactions and compare them to each credit report.

How Do I Find Out My Business Credit Score?

Finding out your business credit score is simple when you use FairFigure.

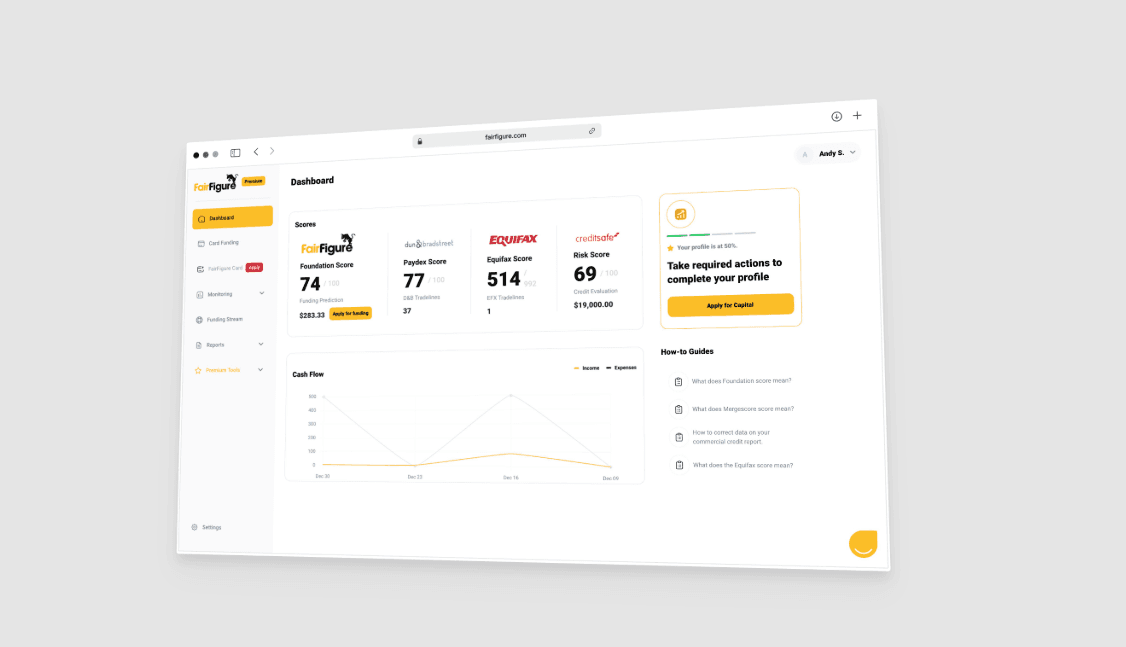

We help you keep tabs on your credit scores and credit history across three credit bureaus: Dun & Bradstreet, CreditSafe, and Equifax.

This gives you a more comprehensive overview of your credit health across each credit reporting agency.

It’s also important to point out that we report activity to credit agencies as well.

When you sign up for our business credit monitoring service or our FairFigure Capital Card, we report to Equifax, the SBFE, CreditSafe, and our own Foundation Report.

With two vendor tradelines, you’ll be able to boost your credit score with ease.

How To Monitor Your Business Credit Reports

FairFigure offers you a free credit report, but our services help you accomplish more than just that.

Our business credit monitoring service is essential to help you build credit and track your progress.

Our business credit monitoring service, as stated above, helps you track your score across three business credit bureaus individually, as well as through the Foundation Report.

Our service also includes features such as:

- Business Credit Corrector: Up-to-date reporting and accurate data are vital to your business credit score. If you notice anything wrong in your business credit report, our Business Credit Corrector will work fast to make any necessary corrections to your credit history.

- Darknet Scanner: Cybercrime is a major concern for modern businesses. Businesses of all sizes are at risk. In fact, around 6 in 10 businesses were hit with ransomware attacks across 2023, and that’s only one type of cyber attack. Our darknet scanner scans the internet to ensure your data isn’t being used maliciously.

- AI Podcasts: Our monthly personalized AI podcasts help you understand your business spending and credit score. They also give you step-by-step guidance on how to build your business credit and optimize cash flow. This ensures you have more than just info from major credit reporting agencies.

When you sign up for this service, you receive a vendor tradeline that reports monthly. You also get access to the FairFigure Capital Card.

How to Improve Your Business Credit

Improving your business credit is simple when you sign up for FairFigure services.

New businesses struggle to build credit, which is where our services come in.

By signing up for our business credit monitoring service, you receive a reliable vendor tradeline that helps you build business credit quickly.

If your business is at least three months old and you generate at least $2,500 in recurring monthly revenue, our FairFigure Capital Card will help you fund your business and build your credit at the same time.

It’s EIN-only, requires no personal guarantee, and doesn’t require you to fill out paperwork.

Sign up for FairFigure today to improve your small business’s credit!