Startup Business Credit Card Limit

Author: Dylan Buckley

January 09, 2026

12 min read

TABLE OF CONTENTS

- 1. What Is a Typical Startup Business Credit Card Limit?

- 2. How Credit Card Issuers Determine Your Starting Limit

- 3. Factors That Affect Business Credit Card Limits for Startups

- 4. Average Business Credit Card Limits by Card Type

- 5. Business Credit Card Limits vs Personal Credit Card Limits

- 6. Getting a Business Credit Card With No Business Credit History

- 7. How to Increase Your Business Credit Card Limit

- 8. High-Limit Business Credit Cards for Startups

Start your credit building journey for your business

A startup business credit card limit will vary based on revenue, creditworthiness, and other factors.

We explore how business card limits are determined, different business card options, and higher limit cards to help you find the right card for your startup.

What Is a Typical Startup Business Credit Card Limit?

Knowing what to expect from your typical startup business credit card limit gives you a better idea of how much financing you’ll have available to you upon approval.

The typical startup business credit card limit hovers at around $50,000. Some limits may be higher, and some limits can reach hundreds of thousands. However, if you’re starting out, you can expect somewhere around $50,000.

Keep in mind that this is in reference to traditional business credit cards. Exceptions may apply when:

- You’re applying for something like a corporate card. Corporate cards can often come with higher limits. Your card issuer won’t conduct personal credit checks, so your bad credit won’t matter. Traditional business credit cards will.

- You’re getting a secured business credit card. Unlike a traditional startup business credit card, a small business secured card will often come with much lower credit limit minimums and maximums. Your security deposit will determine your credit card limit.

- Your card’s limit is revenue-based. Being a startup, you may have less funding to work with, limiting your credit line initially. However, this will grow with you as you do.

How Credit Card Issuers Determine Your Starting Limit

Credit card limits aren’t set and distributed to everyone who qualifies for a card. Rather, your card issuer will determine what your starting limit is based on a wide range of factors. These factors include:

- Personal Credit: Most startups don’t have business credit. Instead, card issuers will conduct a personal credit check. If you have strong personal credit and established credit history proving your fiscal responsibility, you can unlock higher credit limits.

- Business Credit: Once you do build business credit, you can start leveraging this to access financing. Credit card issuers will consider business credit instead. This is ideal as it separates your business and personal finances.

- Business Revenue and Financial Health: A card issuer doesn’t want to issue a high credit limit to a small business with weak revenue and poor financial health. The stronger these aspects are, the higher your credit limit.

- Debts or Derogatory Marks: Existing debts can drag down your potential credit limit. Derogatory marks can influence a card issuer’s decision as well, and they may even get you turned away completely.

- Industry: Businesses operating in high-risk industries or engaging in risky business activity could see much lower limits. As with the previous factor, some may even get turned away from traditional financing solutions entirely.

If possible, see where you can improve above to increase your initial spending limit. This will give you a strong foundation as you build business credit and scale your startup.

Factors That Affect Business Credit Card Limits for Startups

All of the factors above influence business credit card limits for startups. Generally, these are the main factors card issuers are looking at when determining how much to set your credit limit for.

Depending on which startup business credit card you choose, additional factors that may impact your credit limit (or card approval) include:

- Investor Funding: Some cards focus on providing business credit cards for those who have investor funding. Consider this if you have investors. Just make sure that you meet the investment funding requirements. These may be relatively high.

- Current Savings/Available Funds: Some cards require you to have a certain amount in your business bank account to qualify. Check the terms and conditions of your desired startup credit card.

- Time in Business: Your chosen card may require you to have been in business for a certain period of time. This may range anywhere from a few months to a year or more.

Startups don’t lack options for business credit cards. But there are specific conditions that will impact card approval and credit limit. Understand where your startup is to understand what you can expect when applying for various business credit cards.

Consider your options and find the best business credit cards.

Average Business Credit Card Limits by Card Type

As we touched on above, there are several types of business credit cards. You’re not limited to those offered by card issuers at traditional financial institutions, like banks. So what can you expect across the board with different business cards?

Traditional business credit card limits will sit at around $50,000.

Corporate cards are charge cards that look at factors other than personal credit. These startup business credit cards with no credit ein only often have higher credit limits.

There’s not much data on average corporate card credit limits. However, we do have insights into how high they can reach. Ramp states that their credit limits can reach 20x that offered by traditional cards.

Meanwhile, corporate cards like BILL Divvy give a credit limit range. Those who apply for this card can access credit limits ranging from $1,000 to $5 million.

Another option at your disposal is secured credit cards. Secured credit cards aren’t advisable for numerous reasons. They come with security deposit requirements, additional fees, and high interest rates.

Still, they are an option if you need a small business credit card.

Most secured business credit cards will range anywhere from $1,000 to $10,000. But there are some that offer higher credit limits.

Popular options like the Bank of America Business Advantage Unlimited Cash Rewards Mastercard Secured and the First National Bank Business Edition Secured Visa Card are reported to be capped at $10,000.

Meanwhile, options like the Valley Bank Visa Secured Business Credit Card offer a higher limit of up to $25,000. Regardless, remember that this limit is determined by your security deposit. If you want a higher limit, you have to pay for it.

Business Credit Card Limits vs Personal Credit Card Limits

Using a personal credit card for small business expenses is ill-advised. Some people might consider this an option if they can’t secure business cards.

Besides the many drawbacks, the key disadvantage is the difference between business credit card limits and personal credit card limits.

Personal credit cards are designed for everyday spending. As such, even if you’re a high earner, you’re probably not going to get a substantial credit limit that would be suitable for business expenses.

Business credit cards are designed for business spending. Because of this, you have access to higher credit limits off the bat. These are designed for the investments you’ll need to make as you scale your startup.

More than that, your credit limit will grow with you. These cards are designed to scale so as to help you support your business over time. Personal card limits won’t be able to keep up with your business needs.

Beyond just the difference in credit limits, you should stick with business cards because they’ll have less of an impact on your personal finances.

Using your personal credit card for business purposes can lead to maxing out your card, creating a cycle of debt, and heavily impacting your credit score. A business credit card reduces or eliminates the risk of the above.

That being said, take care to research business credit card reporting practices. Many traditional business credit cards do report activity to business credit bureaus. Some only report negative activity, while others will report positive and negative activity.

Getting a Business Credit Card With No Business Credit History

Is it possible to get a business credit card with no business credit history? Absolutely.

For startups, the most important thing to leverage is your personal credit history. Small businesses aren’t going to have a ton of business credit history, so they have to rely on their personal credit anyway.

What you’ll be able to qualify for will depend on your personal credit score. An excellent credit score will open up all the doors. Meanwhile, a good credit score will present limitations.

This is especially true for certain card issuers like Capital One. Almost all of Capital One’s business credit cards require excellent credit. The only business credit card you can get with fair credit is the Spark 1% Classic.

That being said, it’s important to consider all of your business card options. If you’re looking to get a business credit card with no business credit history and low personal credit, a corporate card or similar options can be the right choice.

Corporate cards generally won’t require you to have good credit. BILL Divvy is the only exception. They perform a soft personal credit pull. Others, like Brex, Ramp, and Rho, look at other factors in your business.

Another option if you want to avoid using personal credit (and don’t have much business credit) is fleet cards. If you have several work vehicles and want to save on fuel and other purchases, a fleet card can help you fund those purchases.

This isn’t true of all fleet cards. You’ll fare best with options like the AtoB Fleet Card or the Coast Fleet Card.

How to Increase Your Business Credit Card Limit

You might start out with a lower business credit card limit than you’d like. But these limits are always subject to change. You can increase your business credit card limit over time.

Here’s how:

- Stay on Top of Your Card: Make sure that you’re making on-time payments. Use less than 30% of your available credit line. Maxing out your card for managing business expenses can impact your business credit.

- Work Toward Increasing Revenue: Increased revenue will increase a lender’s likelihood to increase your credit line. Work on scaling your business so that you’re bringing more money in over time.

- Request an Increase: Once you’ve demonstrated your financial management skills and have successfully increased your revenue, request an increase, providing your card issuer with all the necessary paperwork to streamline the process.

While you’re doing all of this, make sure that you’re also focused on building business credit. Building your business credit will enable you to become eligible for higher credit limits with other cards.

High-Limit Business Credit Cards for Startups

If you’re specifically looking for high-limit credit cards, there’s no shortage of options. Here are some of the best business credit cards for startups.

Ramp

Ramp is a corporate charge card that offers up to 5% savings in rewards and perks, strong spend controls and expense visibility, and integrations with a wealth of financial tools you likely already use.

Ramp doesn’t explicitly state how high their credit limits are. They only state that they can reach up to 20x more than what traditional cards offer.

Brex

The Brex Corporate Card is designed for startups and enterprises. They offer high rewards (up to 7x cash back), help you track expenses and automate compliance, and enable you to create cards for specific vendors and types of spending.

They report that limits can reach over $100,000.

Zeni.AI’s Business Credit Card

Zeni is best known for their AI bookkeeping software and expert financial services. But they also offer their own business credit card. If you’re exploring all of the best business credit cards (and looking for other perks upon account opening), consider this one too.

Zeni’s Business Credit Card is characterized by 1.75% cash back, no fees, AI spend management that tracks and categorizes expenses for you, and seamless spend control and financial visibility.

They don’t state outright what credit limits will look like, but they do highlight higher credit limits as being one of the major perks of their card.

The Capital One Spark Cash Plus Card

The Capital One Spark Cash Plus Card is a charge card. It offers 2% cash back, the opportunity to earn thousands of dollars extra in the first year, and the chance for an annual fee refund ($150).

It has no preset spending limit, which means it adapts to your needs. It’s also more affordable than other options, like the American Express Business Platinum Card.

Do You Need a High Credit Limit as a Startup?

Having a higher credit limit as a startup will prove extremely useful for your company. The higher your credit limit, the more funding you’ll have at your disposal for everyday purchases, business activities (marketing, etc.), and major investments.

More than that, you need a higher credit limit so you can use up to 30% of your available credit line without going over.

A high credit limit is essential for a startup owner. Consider the above so that you can position your startup better and receive higher credit limits right away.

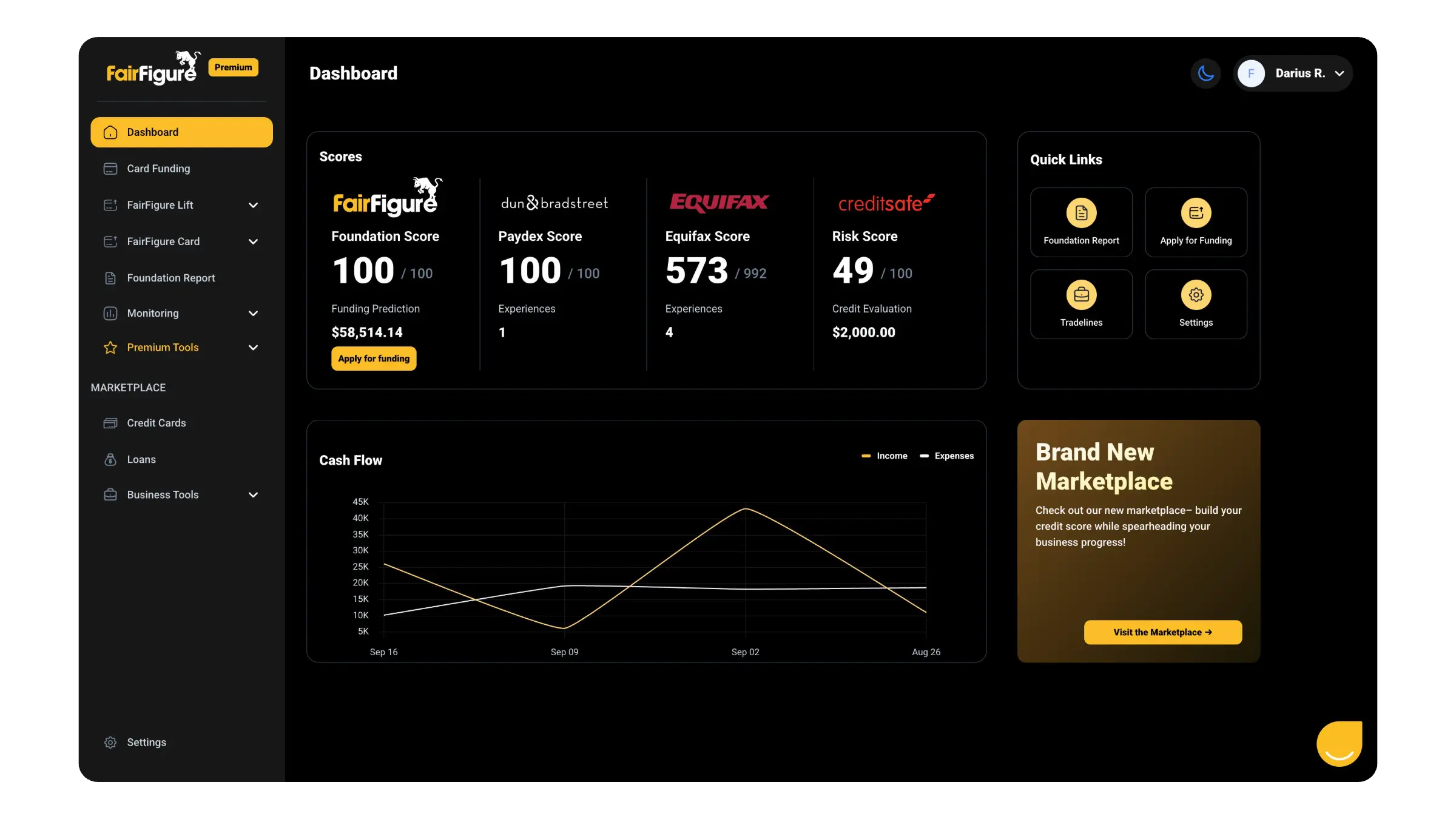

Funding your startup is crucial to progress and success, but it can be challenging. FairFigure can help with this.

Need a business credit card no personal credit check? The FairFigure Capital Card is an employer identification number (EIN)-only, no pg business credit card that funds your business based on revenue, all while helping you build your business credit at the same time.

Register for FairFigure today!

More articles

Read More >

February 12, 2026

1 min read

February 12, 2026

1 min read

February 12, 2026

1 min read

Start your credit building journey for your business

Start your credit journey now with FairFigure